Thailand Leading Way as Industry Alternative to China

TAIPEI – Taiwan’s PCB industry continues to expand its factories in Thailand and Vietnam to strengthen the resilience of the global PCB supply chain, and representatives of the Taiwanese and Thai governments are actively negotiating for assistance to Taiwanese factories, says the Taiwan Printed Circuit Association.

According to a client survey conducted by Goldman Sachs Group in early 2024, 54% of respondents see geopolitics as the main risk to the current market and the global economy, while the threat of inflation has eased. In addition to cost-effectiveness and market operations, geopolitics has become an important consideration in international supply chain strategic planning. Against this backdrop, Southeast Asia has become a direct beneficiary of the global PCB and electronics supply chain.

In addition to the advantages of abundant labor and relatively low labor costs, the geopolitical risks in Southeast Asia are also limited. Amid the current international tensions, the region has become a popular choice for enterprises seeking an alternate production base, which is conducive to promoting the development of the local PCB industry. Among them, Thailand has a leading competitiveness in the region by virtue of its relatively mature PCB and downstream electronics industry. In 2023, Thailand’s PCB local production output will account for about 3.8% of the world’s total, and it is expected to grow to 4.7% in 2025 as the world’s major PCB manufacturers continue to deploy locally.

Although the PCB supply chain in Southeast Asia is still in the early stages of development, and manufacturers still face many hidden costs, the implementation of the ASEAN Common Tariff Agreement will help improve the regional trade environment and make up for the supply chain shortcomings, TPCA said. It is expected that the initial challenges will be gradually overcome over time, resulting in improved overall cost-effectiveness, the trade group added.

Hot Takes

Printed circuit board assembly production by EMS companies achieved record revenues of 57.3 billion euros in 2023, with EMS outsourcing representing 43% of the total available market of Europe’s PCB assembly. (in4ma)

The US lacks the capacity – even with the 109 fabs planned to come into operation by 2026 – to see its semiconductor industry become a $1 trillion market by 2030. (SEMI)

Global PC shipments are predicted to reach 265.5 million units in 2024, up 2% from the prior year. (IDC)

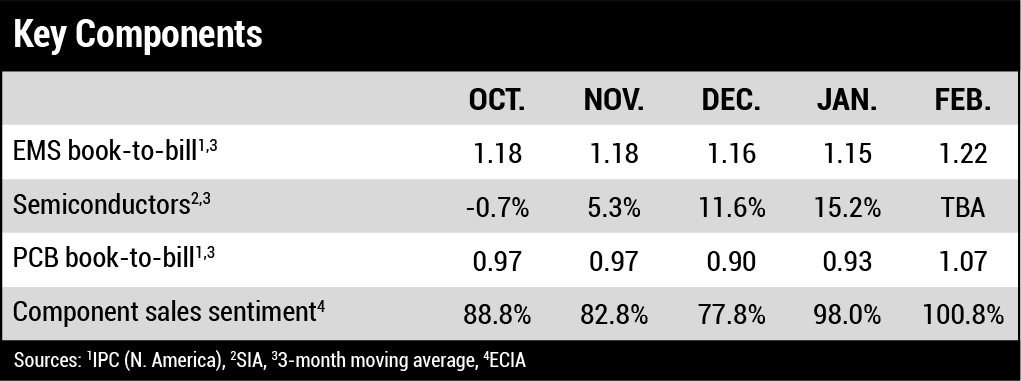

Total North American EMS shipments in February rose 4.1% year-over-year and fell 0.8% sequentially. Bookings increased 26.4% year-over-year and increased 16.5% from January. (IPC)

The pace of Bay Area tech layoffs so far in 2024 remains below the cutbacks in the industry over the same time frame in 2023 – even as a widening number of technology companies continue to chop employees. (GovTech)

The value of exports from Taiwan grew 1.3% in February, year on year – weaker than the prior three months. (ING)

The global market for AR/VR headsets grew 130% year-over-year during the fourth quarter. (IDC)

The Taiwanese PCB industry is actively expanding its operations into ASEAN countries, such as Thailand and Vietnam, to enhance the resilience of the global PCB supply chain. (DigiTimes)

Global shipments for gaming PCs declined 13% year-over-year to 44 million units in 2023, yet gaming monitors bucked the trend, growing 20% as lower pricing helped drive volume. (IDC)

Global semiconductor sales totaled $47.6 billion in January, an increase of 15.2% compared to the January 2023 total of $41.3 billion. (SIA)

North American PCB shipments fell 11.6% in February versus a year ago but rose 7.1% sequentially. Bookings were up 25.6% and 47.5%, respectfully, compared to the previous year and month. (IPC)

Shipments of artificial intelligence PCs – personal computers with specific system-on-a-chip (SoC) capabilities designed to run generative AI tasks locally – will grow from nearly 50 million units in 2024 to more than 167 million in 2027. (IDC)

Semiconductor revenue growth of 12% is expected in 2024, followed by 21% growth in 2025. Moderated growth is anticipated in 2026 as the market enters a downcycle later that year. (Techcet)

India’s technology sector is expected to grow 3.8% to $253.9 billion in 2024, compared with the previous fiscal year’s 8.4% as clients hold back spending and delay decision-making. (National Association of Software and Service Companies)

Taiwan-based notebook ODMs, several of which experienced sequential shipment decreases in January, are expected to witness a pickup in March shipments. (DigiTimes)

The global semiconductor materials market is set to grow nearly 7% as conditions turn favorable in 2024. (Techcet)

Q4 foundry revenues rose 7.9% to $30.49 billion, primarily driven by demand for smartphone components, such as mid and low-end smartphone APs and peripheral PMICs. (TrendForce)