Q1 EMS Deals Slip, but M&As Expected to Rise Over Time

CHICAGO – Nine EMS transactions took place in the first quarter, one less than reported in the first quarter of 2023, Lincoln International recorded in its latest EMS Quarterly Review.

Of those transactions, four were EMS consolidations, while vertical/horizontal convergence accounted for five of the transactions, the highest number of vertical/horizontal transactions in the previous three years.

By geography, Europe had four transactions, Asia had three transactions, and two were cross-border transactions. US/Canada did not record a closed transaction in the quarter.

Small-tier EMS providers accounted for two of the transactions, while five transactions were categorized as mid-tier EMS deals and two transactions were categorized as large-tier EMS deals.

Mergers and acquisitions activity is expected to rise in 2024-25, the report found, especially with middle-market EMS companies, driven by demand resiliency and broader market improvement. With the EMS sector set to expand significantly, more M&A activity is expected for consolidating key capabilities and introducing additional capital to realize near- and long-term growth.

Hot Takes

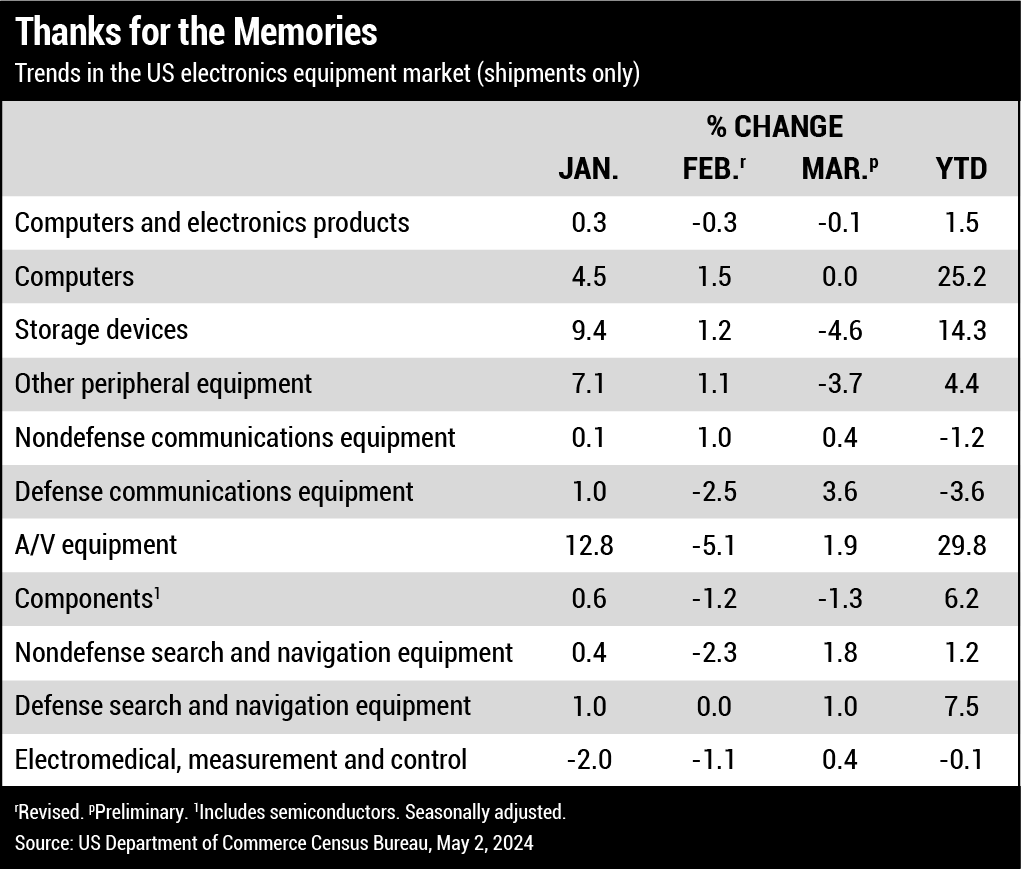

Smartphone and PC shipments will each show growth of around 2% this year, driving small unit shipment growth in all package categories. (TechSearch International)

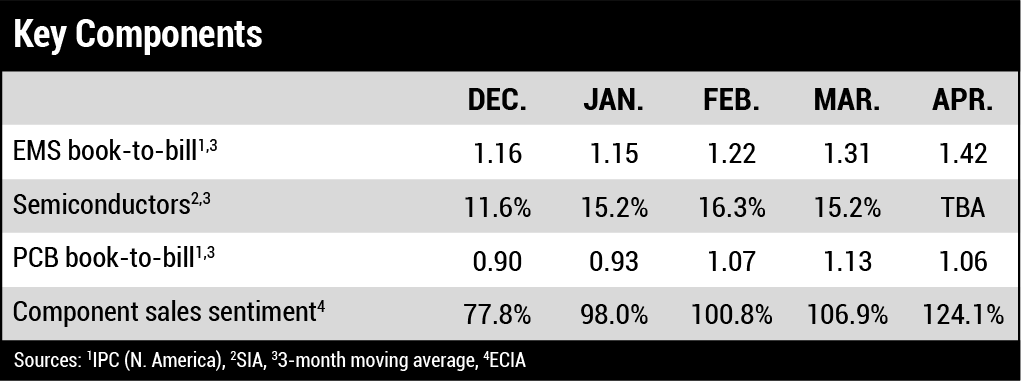

North American EMS shipments in April fell 2.1% compared to the previous year, and decreased 1.9% sequentially. Bookings rose 33.6% year-over-year and increased 16% over March. (IPC)

New US tariffs on Chinese imports – including a 50% duty on semiconductors – have accelerated a shift in supply chains toward Taiwanese wafer fabs. (TrendForce)

The US will triple its domestic semiconductor manufacturing capacity from 2022 – when the Chips Act was enacted – by 2032. (SIA)

April PCB shipments by North American fabricators rose 9.4% year-over-year and 18.6% sequentially. Bookings ticked up 2.6% over 2023, while bookings rose 2.9% month-over-month. (IPC)

After more than two years of decline, worldwide tablet shipments posted year-over-year growth of 0.5% in the first quarter, totaling 30.8 million units. (IDC)

Taiwan’s major PCB manufacturers are investing heavily in Southeast Asian nations to develop production capacity. (TPCA)

Taiwan’s export orders grew by 10.8% annually in April, the highest year-on-year growth in two years, thanks to robust demand for chips used in AI and HPC devices. (Taiwan Ministry of Economic Affairs)

Sales of electronic goods in India grew 24% in 2023. (Global Trade Research Initiative)

A bipartisan group of four senators is recommending that the US Congress spend at least $32 billion over the next three years to develop artificial intelligence and place safeguards around it. (Associated Press)

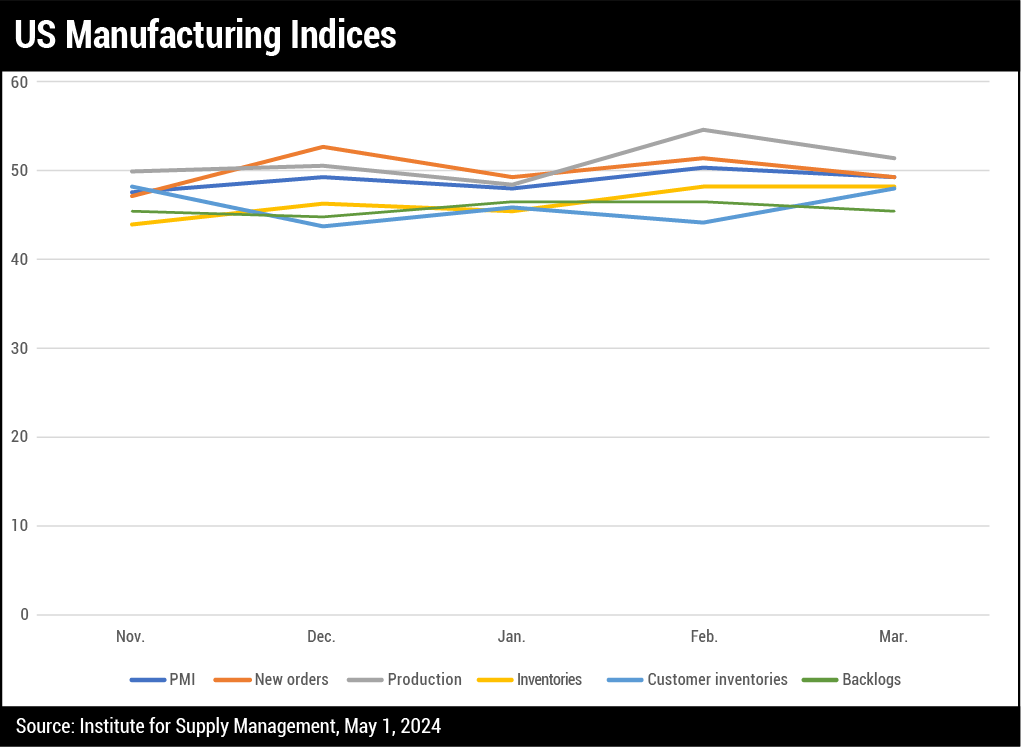

Sentiment among electronics manufacturers fell in May after hitting a new high in April, but remains historically high. (IPC)

First quarter electronic sales rose 1% year over year, with Q2 forecast to register a 5% increase. IC sales were up 22%, and are expected to grow 21% in Q2 on improved demand for high-performance computing (HPC) chips and higher memory pricing. IC inventory levels stabilized in Q1 and are expected to improve this quarter. (SEMI)

DRAM contract prices are expected to increase by 13-18% in the second quarter, while NAND contract prices are expected to increase by 15-20%. (TrendForce)

India’s goal to reach $300 billion in electronics production by fiscal 2026 will require some $100 billion worth of chips. (India Cellular and Electronics Association)

Leading European research labs will receive 2.5 billion euros ($2.72 billion) in funding under the European Chips Act to set up a pilot line to develop and test future generations of advanced computer chips. (Imec)