Electronics Industry Sentiment Rose at end of July

BANNOCKBURN, IL – Sentiment in the electronics industry saw a modest uptick in August, though it remains below the peak observed in April, IPC said in a report released in mid-August. The results are based on a survey conducted Jul. 18-31.

Regarding current supply chain conditions, half (50%) of electronics manufacturers responding said they are currently experiencing rising labor costs, with 46% reporting increased material costs. At the same time, ease of recruitment, profit margins and backlogs are presently declining. Over the next six months, electronics manufacturers expect labor and material costs to remain high, although relatively stable. Profit margins and backlogs are expected to rise, with recruitment challenges continuing to persist.

Some 42% of respondents are very or extremely concerned about geopolitical risks and 44% are concerned with trade policies and tariffs, with no significant differences by geographical regions.

Additional survey data show:

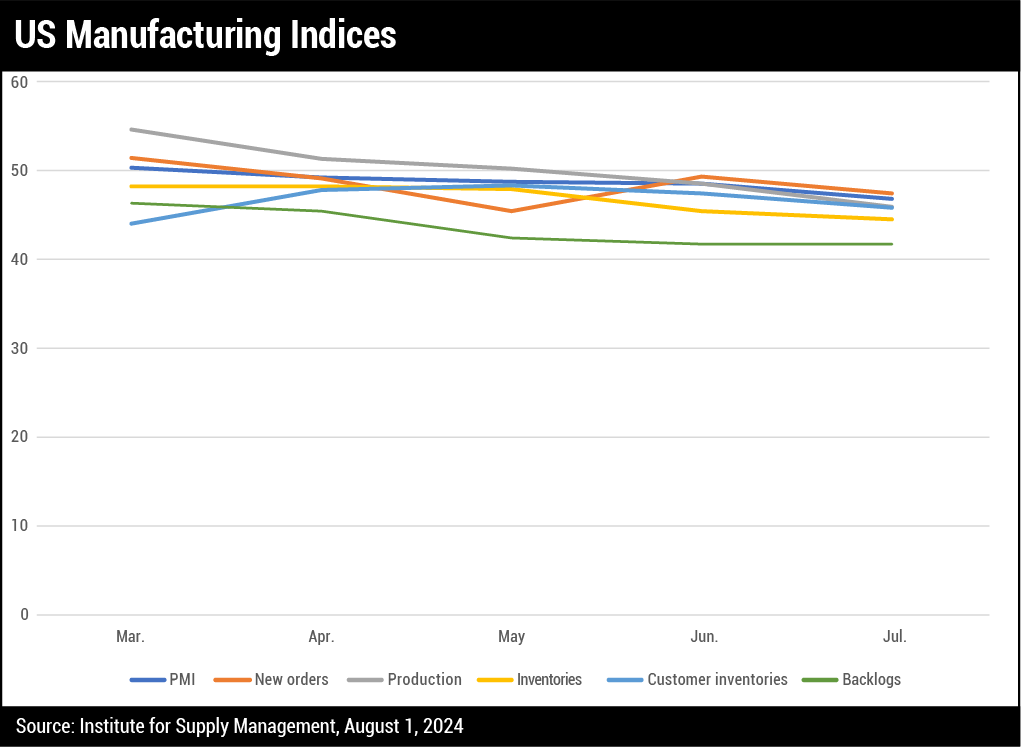

- The demand index increased 3.3% in August, fueled by better, albeit still contracting, backlog, capacity utilization that shifted to expansion, and heightened order sentiment.

- Cost pressures eased slightly in August, with indices for labor costs and material costs each dropping one point. Despite the declines, both indices remain in expansion territory, indicating a majority of businesses continue to face cost challenges. Notably, the labor costs index hit a new low for the year.

- The overall industry outlook remained robust in August, although demand sentiment has cooled from earlier highs this year.

Hot Takes

Sales of PCB materials (excluding flex) dropped 16% year-over-year to $57 billion in 2023. Copper-clad laminate sales made up about $13 billion, including prepreg but excluding mass laminate. Some 650 million sq. m. of rigid laminate materials, including paper, composite, FR-4, and specialty laminates were sold, down slightly from 2022. (Prismark)

The global flex PCB market will gradually recover from its 2023 downturn, with the market size expected to reach $19.7 billion in 2024, representing a 7.3% year-on-year growth. (TPCA).

Japan’s PCB output has shrunk for 19 consecutive months through May, but the decline has only been in the single digits for the past three months. (JPCA)

North American PCB shipments in July fell 21.2% versus a year ago and sank 14% sequentially. Bookings were down 25.4% and 17.3%, respectively. (IPC)

The European PCB industry saw a year-over-year decline in billings of 6.5% during the first half of 2024. (Data4PCB)

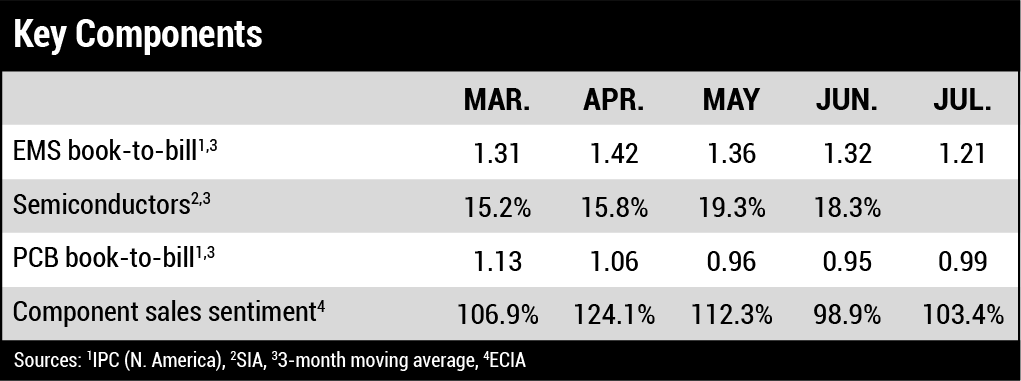

North American EMS shipments in July rose 1.9% over July 2023 and were up 1.9% over June. Year-over-year bookings increased 0.2% and quarter-over-quarter bookings rose 0.1%.

Packages using chiplet architectures will grow at 69% compounded annually from 2023 to 2029. (TechSearch International)

Worldwide silicon wafer shipments in the second quarter declined 8.9% year-over-year, but rose 7.1% quarter-over-quarter. (SEMI)

Major PCB and IC substrate manufacturers from Taiwan are expanding operations in Southeast Asia but face sustainability challenges amid uncertainties of electricity and water supply. (DigiTimes)

Three EMS transactions were recorded in the second quarter, down from five recorded in 2023’s second quarter. (Lincoln International)

Global semiconductor sales totaled $149.9 billion during the second quarter, an increase of 18.3% compared to 2023 and 6.5% more than the first quarter of 2024. (SIA)

Taiwan’s export orders rose more than expected in July as demand for chips used in artificial intelligence applications continued to soar and the government said it expects the momentum to extend into August. (Taiwan Ministry of Economic Affairs)

Taiwan-based ODMs are cautiously optimistic about consumer electronics product demand in the second half of this year, according to industry sources. (DigiTimes)

DRAM sales saw revenue growth of $22.9 billion in the second quarter, a sequential rise of 24.8%, on higher shipments of mainstream products. (TrendForce)

The amount of data center supply under construction in North America’s top markets jumped by about 70% compared to a year ago to a record 3.9GW. (CBRE Group)

Worldwide spending on artificial intelligence, including AI-enabled applications, infrastructure and related IT and business services, will more than double by 2028 to $632 billion. (IDC)

North American EMS shipments in July were up 1.9% compared to 2023 and increased 1.9% sequentially. Bookings increased 0.2% year-over-year and 0.1% from the previous month. (IPC)