Taiwan Leading PCB Recovery

TAIPEI – Taiwan’s printed circuit board sales rose 12.7% year-on-year in the second quarter on strong demand for AI servers, satellite communications, and automotive electronics, as well as a moderate recovery in the mobile phone and memory markets, the Taiwan Printed Circuit Association said in September. Total sales reached NT$191 billion ($5.97 billion) in the second quarter, TPCA added.

Following five quarters of recession, the carrier board resumed growth in the second quarter, with an annual growth of 2.6% on a recovery in the mobile phone and memory markets, offset in part by lower demand in the computer and networking infrastructure markets, which slowed sales of ABF carrier boards. Multilayer boards increased 13% year-over-year on strong demand for AI servers; HDI grew 21.2% driven by demand for AI servers, low-orbit satellites and automotive electronics. Flex and rigid-flex boards grew 12.8% and 19%, respectively, due to the recovery of the automotive and mobile phone markets.

In the June quarter, the communication application market grew 32%, due mainly to mobile phones and satellite communications. Computer applications grew 11%, driven by demand for AI servers and recovery of the general server market. Automotive was up 11% on electric vehicle sales. The impact of economic uncertainty and high inflation softened consumer sales, which declined 14%, the only end-market to fall.

The main production bases of Taiwan’s PCB industry are still concentrated in the Chinese mainland, accounting for about 62% of the output value during the period. Mainland Taiwan accounted for about 35%, TPCA said.

Meanwhile, driven by customer requirements, Taiwanese companies are actively expanding into Southeast Asia, and Thailand has become the focus of investment.

Hot Takes

Overall PCB output in Japan, including IC substrate production, fell 10.9% to 751,000 sq. m in June. Rigid board production was down 13.6% and flex circuits decreased 1.3%. (JPCA)

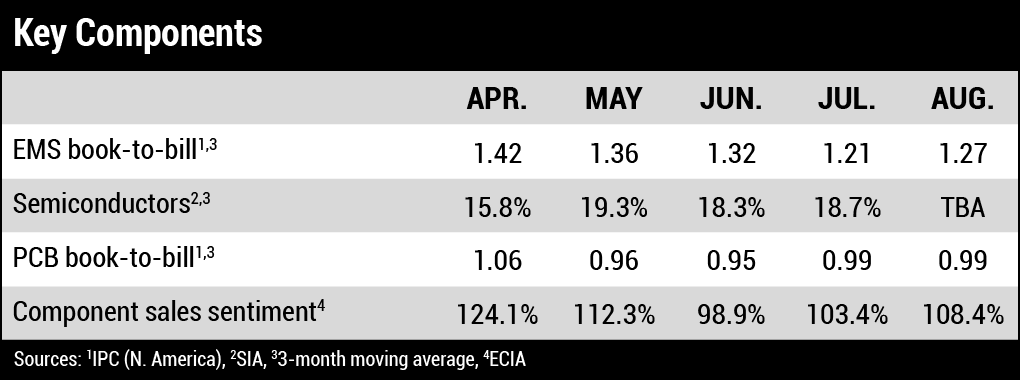

North American EMS shipments fell 4.4% in August versus a year ago and were down 1.3% sequentially. Bookings rose 16.4% year-over-year and 24.3% from July. (IPC)

China spent more on semiconductor manufacturing equipment in the first half of the year – $25 billion – than Korea, Taiwan and the US combined. (Nikkei)

Worldwide smartphone shipments are forecast to grow 5.8% year-over-year in 2024 to 1.23 billion units. (IDC)

North American PCB shipments in August rose 35% from last year and decreased 10.3% from July. Bookings rose 44.2% year-over-year, and were up 22.3% sequentially. (IPC)

Vietnam’s electronics exports year-to-date were $77.4 billion as of Aug. 15, up 20% year-on-year. (Vietnam Customs Department)

Wafer foundries are expected to grow 20% in 2025, up from 16% in 2024, despite weak demand for consumer products, which has led component manufacturers to adopt a conservative stocking strategy and lowered the average capacity utilization rate of wafer foundries by 80% in 2024. (TrendForce)

Worldwide hardcopy peripherals shipments declined 1.5% year-over-year to nearly 19.2 million units in the second quarter. (IDC)

Chip sales in America have overtaken chip sales in China for the first time in five years, with the US’ July sales of $15.4 billion beating out China’s sales of $15.2 billion. (SIA)

Global PC monitor shipments grew 5.9% in the second quarter. (IDC)

Singapore’s electronics exports rose 35% in August from a year earlier, the most since 2010, fueled by overseas sales of ICs and disk media products. (Enterprise Singapore)

Global semiconductor equipment billings increased 4% year-over-year to $26.8 billion in the second quarter. (SEMI)

India’s total electronics production in 2024 was $115 billion through July, of which around $52 billion was mobile phones, and will need to grow at an annual growth rate of 20-22% to reach the $500 billion target by 2030. (India Cellular and Electronics Association)

NAND flash prices continued to rise in the June quarter as server inventory adjustments neared completion and AI spurred demand for high-capacity storage products. (TrendForce)