VVDN Goes Vertical

India’s largest ODM is looking to add PCB fabrication to complete its end-to-end mix.

by Mike Buetow

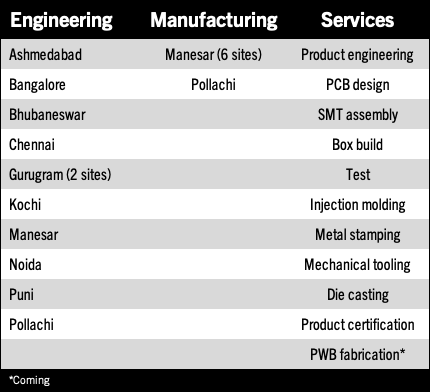

VVDN is perhaps best known as a provider of end-to-end engineering and manufacturing of hardware, mechanical and electronics assemblies, and embedded software, among others. Founded in 2007, it now has 11 product engineering centers worldwide, plus seven manufacturing plants across India, where its capabilities include SMT injection molding, tooling, die casting and metal stamping among others.

VVDN builds products for a range of end-markets, including cameras for surveillance and security communications products such as 5G radio units and 4G and 5G antenna; consumer products like wearables and Wi-Fi-based access points; computing products like HPCs and telecom servers, laptops and tablets; and automotive electronics such as automotive vision systems, ADAS, EV chargers, infotainment systems and more.

The company, which says it is India’s largest ODM, in February announced plans to invest $100 million over the next five years in a new 100-acre factory in Tamil Nadu. That plant will add PCB fabrication capability, rounding out the firm’s vertical integration strategy.

We spoke in late March with cofounder and president of engineering Vivek Bansal on the PCB Chat podcast. The following has been edited for clarity and length.

Mike Buetow: VVDN is probably not well-known to many in our audience, but your backstory is a familiar one. VVDN stands for voice, video, data, and network. You and your partners were Silicon Valley engineers who cofounded your company in 2007. What can you tell us about your original goals?

Vivek Bansal: When we started this company, we were working for different companies. I worked for Hughes and my colleagues were working for companies like Cisco, and back then the whole electronics product development was conducted in a manner where the electronics were done in Taiwan. Taiwan was big at that time, and China was coming up. And all the software development was happening out of India. There was literally no one company that would do the full electronics and software. We thought that was a big opportunity for VVDN and we thought we could be a one-stop solution providing end-to-end capabilities in terms of electronics.

With that idea in mind, we started this company and early on we were able to excite a lot of customers in North America, to engage with us to do both hardware and software. This whole model turned out to be very successful. We started as a design house; for the first few years we were working as a design company and eventually we got into manufacturing.

MB: Even though you started with the software side, the plan all along was to add manufacturing.

VB: That is correct. We always knew that ultimately that’s a huge potential for VVDN and, being in India, we really thought that we would stand out and be one of the market leaders if we not just do design but also manufacturing.

MB: As you know, in that time frame, the supply chain was very segmented, with design, manufacturing and assembly and test all spread out among different companies and the vertical integration model that HP, IBM, Digital Equipment and a lot of the Japanese OEMs had developed was really getting taken apart.

What caught my eye was a company announcement in February regarding a new factory in Tamil Nadu. The factory calls for a $100 million, 100-acre manufacturing plant to be built over the next five years. Now, as part of that, you plan more SMT capacity, correct?

VB: That’s right.

MB: And its expansion will include printed circuit fabrication, meaning VVDN will truly become vertically integrated. What prompted that decision to add bare board fabrication?

VB: VVDN has been continuously investing internally to do as much backwards integration as possible. We started literally doing SMT in-house and gradually added mechanical tooling, injection molding, die casting … all of that.

Now the next natural expansion was to do our own printed circuit boards. Today we go outside. A lot of our vendors are in China. What happens is, any time we do a new design, doing a PCB for the first time takes about six weeks or slightly longer. Literally we are waiting just for the boards to come and that’s quite a long period. We thought: Why don’t we bring in this process internally in the company, as we will shorten our lead times. And looking at the scale that we have, the kind of volumes we are doing right now, we almost buy millions of quantities of these PCBs on a year-on-year basis. And the volumes are increasing. We thought, it’s best to bring in that capability internally as it will shorten our lead time and reduce the logistics pain. With all that in mind, we decided to set up internally in the company. The work has just started and in the next 12 months we will have a state-of-the-art facility in Tamil Nadu which will start producing printed circuit boards.

MB: That’s a remarkable development, in my opinion. A lead time of six weeks for a company that does so much engineering – and a really high number of designs and NPI work – I could see that being very restrictive to have to wait that long.

India’s bare board fabrication infrastructure is still in the early stages. Nearly all laminate equipment and chemicals must be imported. Are you taking any steps to ensure a consistent supply base prior to actually coming online?

VB: All that will definitely happen as we get into this process. We will have to take all the necessary steps to make sure the supply chain and chemicals are available on time. And we will keep enough inventory on our side. Like I said, our volumes are quite significant. To cater to those volumes, we will have to maintain a decent supply chain on our side.

MB: Will you take orders just for bare boards from customers, or will all the fabrication be used as part of your vertical integration strategy?

VB: That’s going to happen. The way we run our manufacturing, each of the units has its own P&L. They run as independent operations. While this unit will manufacture for VVDN, it would continue to function as an independent unit to support any other customer, not just in India, but globally. This will do PCB manufacturing for customers across the globe.

MB: The best data I have suggest that the domestic Indian PCB production is about $350 million per year, of which about 50% is exported. Meanwhile, India imports about $1.2 billion worth of PCBs each year, so that suggests a robust market opportunity in front of you.

VB: That’s right. And another thing, at this moment, the kind of PCB fabrication we do in the country is literally lower-end PCBs, up to four layers, some impedance-controlled. It’s a slightly lower end on the scale, which is why you see more imports, because all the complex PCBs are coming from outside. This fabrication unit should be able to produce PCBs for data center servers, [those type of] complex boards. It should be able to do a 28- to 30-layer PCB. Also, very complex, dense PCBs with buried vias and all that.

MB: On the basis of the end-products that you buy, I was thinking about the types of boards that would be required and they would absolutely have to be HDI, very high-layer-count boards. You would instantly become one of the most sophisticated bare board fabricators in the country.

VB: That is right. My vision for the scale and level and quality we want to produce would be to cater to the top customers in the world. We really want to set up something that will be top of the line.

MB: VVDN employs more than 10,000 workers, and I’ve heard you have plans to hire some 25,000 more in the next five years. Is that correct?

VB: That’s correct. You know, VVDN is doing phenomenal. Things are going very well for us, and there is this huge business opportunity out there. The kind of products and solutions that we are doing already, quite a few of them are in production today, but many more designs are going on at this moment which will soon get into production, and the scales and volumes are significantly very high. I’m assuming to take care of all those requirements, we will have to hire the number of people that you just mentioned. We will have to do that for sure.

MB: Does that imply that you expect that most of the employees you hire will be on the manufacturing side? Or are you going to staff up on the engineering side as well?

VB: We are going to staff up on the engineering side as well. The way VVDN is, we are an engineering-led manufacturing company. We have deep engineering capabilities combined with manufacturing capabilities. We have almost 5,000 engineers in the company and we are continuously ramping up. We are hiring more people, so absolutely we’re going to be investing more and more on the engineering side.

MB: Do you have plans for expansion offshore or will that staffing be more or less dedicated to India.

VB: India, of course, is our current focus at this moment. But we are looking for global expansion. We opened an engineering office in Vietnam. We are staffing our US office with more engineers, solution architects, technology evangelists. We are also exploring a manufacturing facility overseas; it could be in Mexico to begin with, and there could be another in Europe, but those are the long-term, next one to two years plan. We have to do that eventually. Looking at all our customer demands, we will have to be in those places. To answer your question, we are looking to ramp up overseas as well.

MB: Some notable Indian electronics manufacturing companies have gone public recently: Dixon Technologies, Syrma and Avalon, among others. VVDN is privately held. Do you have any plans for a public offering?

VB: We do have plans for public offering in the next couple of years. Certainly, we plan to go public. Looking at how VVDN is growing, we want to pass on the benefit to all our employees and our shareholders. We do plan to go public in the next three to four years, depending on the market situation.

MB: The Indian government has placed a concerted emphasis on building up its manufacturing sector. At this time has that translated to improvements in the supply chain, logistics and market access?

VB: Definitely, Mike, there is a huge improvement. The Indian government has come up with something called PLI schemes, which is “production linked incentive,” and VVDN is one of the big beneficiaries of those schemes. As a result, it’s encouraging a lot of local design and manufacturing. All the chip companies have a deep focus in the country. They are making their chips more available here. There’s huge improvement. The government additionally is improving the large stakes, infrastructure imports and exports. With the current government there is huge focus and a lot of action on the ground. We see improvements on a day-to-day basis.

MB: When you think about all your different customers, what does the ideal customer look like to you? What kind of company is the best fit to use VVDN?

VB: This is a little tricky. We are going after quite a different variety of customers at this moment. We work with large customers, in billions of dollars in terms of revenue. We work with a lot of mid-sized companies as well, and we like to work with several startups. We feel proud that a lot of startups have grown with us and today a few of them have billion-dollar valuations. We like to work with all of them.

MB: So despite your relative size and the breadth of capabilities you offer, you feel emerging companies also could find a home inside VVDN?

VB: Yes, absolutely, absolutely. It’s almost been 15 years since we started this company. We want to support the world with innovative products coming out of India and, within the country, we want to innovate, create new products, generate a lot of jobs and support the country as much as possible.

Mike Buetow is president of PCEA (pcea.net); mike@pcea.net.