CCL Demand Took Hit in 2022, Says Prismark Study

COLD SPRING HARBOR, NY – Compared to 2021, 2022 was a tough year for the copper-clad laminate (CCL) market. Some main reasons include inventory adjustments by end-market customers, declines in material ASPs, and exchange rate fluctuations. Lower demand for PCs, TVs, and consumer electronics applications impacted the conventional materials market. All these factors resulted in a sharp decline in both revenues and profits for CCL materials suppliers throughout 2022.

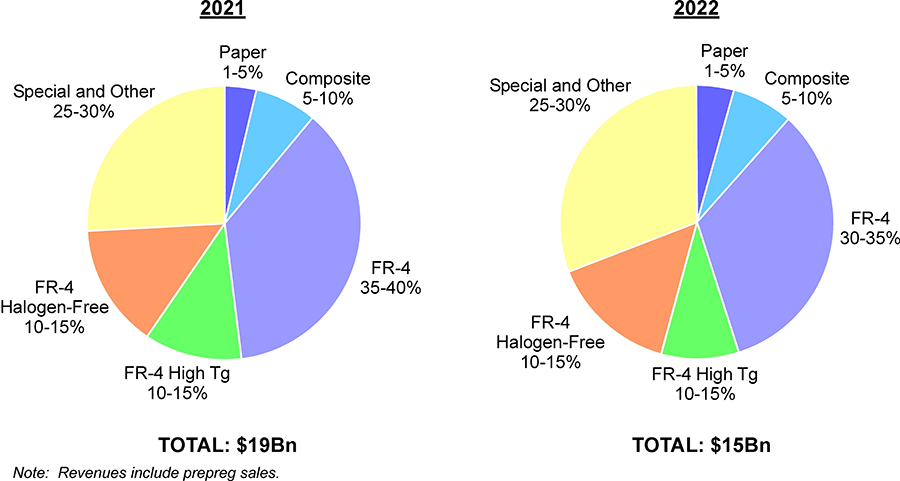

In 2022, the $68 billion rigid printed circuit board industry (excluding flex) consumed over $15 billion of copper clad laminates, including prepreg but excluding mass laminate – a decrease of some 19% from 2021. In area terms, the CCL market represented 664 million m² of rigid laminate materials, including paper, composite, FR-4, and specialty laminates/other, a decrease of more than 13% from 2021. The 2022 CCL market thus saw significant declines compared to the strong growth in 2021, caused by weak demand for end-applications (especially in consumer electronics and PCs), inventory adjustments from PCB suppliers, and the gradual stabilization of raw materials pricing. These factors together contributed to a decline in ASPs. In terms of sales, the top 10 laminate suppliers in 2022 represented 75% of the market.

The top four laminate manufacturers in 2022 were Kingboard, Shengyi Technology (SYTECH), Nan Ya Plastics and EMC, which combined represent almost half of the overall market (excluding mass laminate).

The CCL market declined in 2022 in area terms due to weak demand from PCB fabricators for almost all types of CCL products. Paper, composite and FR-4 products suffered the most in 2022 as demand and ASP declined substantially.

Specialty materials managed roughly 3% growth, which was mainly driven by the demand from high-end server and networking systems. Specifically, the high-speed laminate market benefited from the high-performance computing and data center equipment markets, while the high-frequency laminate market benefited from the automotive ADAS radar and the wireless infrastructure markets. The market for laminates for package substrates was perhaps the most disappointing, as the sales of all major suppliers declined even though the package substrates market experienced continuously strong growth in 2022, especially during the first three quarters. The disconnect between the package substrate and corresponding laminate shipments was apparently due to inventory adjustments.

Although 2022 already saw a significant decline in value and volume, ASP of laminates remained above pre-pandemic levels. First-half 2023 prices continue to decline, however. – Zoey Wang, Prismark Partners (prismark.com)

Hot Takes

The global flexible PCB market is expected to total $17.2 billion in 2023, a 12.6% drop from 2022, but a recovery is expected for 2024. (TPCA)