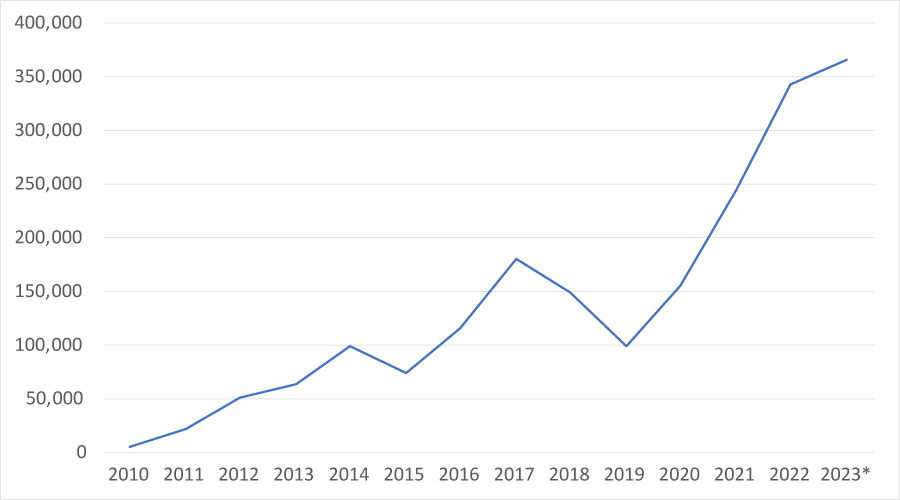

Reshoring Job Announcements on Record Pace in 2023

SARASOTA, FL – Reshoring and foreign direct investment job announcements continued their record-breaking run in the first half of 2023, according to the Reshoring Initiative’s “1H 2023 Report.”

The Initiative expects to see roughly 300,000 jobs announced by year-end, with EV battery and chip investments, along with other essential product industries, accounting for the bulk of the announcements.

According to the report, several factors have come to light that substantiate the strength of US reshoring and FDI trends. In the first quarter of this year, average spending on US factory construction was more than double the average from the past 17 years. Reshoring Initiative data parallels the magnitude and focus of the construction investments.

Independently conducted surveys on reshoring actions by US companies also correlate very closely with Reshoring Initiative data on jobs announced over the past 12 years, adding validity to both data sets.

The “1H 2023 Report” contains data on US reshoring and FDI by companies that have shifted production or sourcing from offshore to the United States.

“We publish this data to show companies that their peers are successfully reshoring and that they should reevaluate their sourcing and siting decisions,” said Harry Moser, founder and president of the Reshoring Initiative. “With 5 million manufacturing jobs still offshore, as measured by our $1.2 trillion/year goods trade deficit, there is potential for much more growth. We also call on the administration and Congress to enact policy changes to make the United States competitive again.”

Read the full report here.

Hot Takes

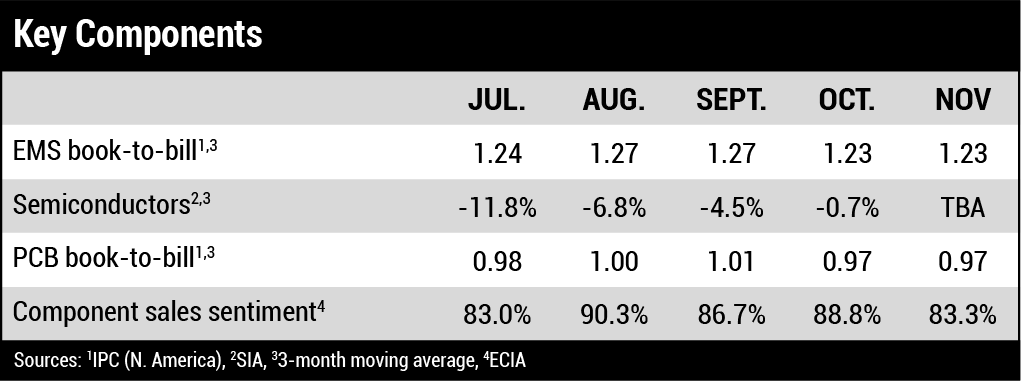

Semiconductor sales worldwide are expected to contract 9.4% for 2023, followed by a robust recovery in 2024 with an estimated growth of 13.1%. (WSTS)

North American electronics manufacturing services in November shipments rose 0.2% from last year and slipped 1.4%from October. Bookings fell 10.1% year-over-year and increased 4.3% sequentially. (IPC)

India’s electronics exports grew 26% in 2023 to $26.8 billion, while imports of finished electronic goods dropped to $13.8 billion in 2023 from $15.4 billion in 2022. (GTRI)

Global sales of semiconductor manufacturing equipment by OEMs are forecast to fall 6.1% to $100 billion in 2023 but are predicted to rise to a record $124 billion in 2025. (SEMI)

Worldwide smartphone shipments are forecast to see 7.3% year-over-year growth in the fourth quarter. (IDC)

North American PCB shipments in November were down 22.5% year-over-year and down 16.3 from October. Bookings fell 9.2% from last year and fell 9% sequentially. (IPC)

Global semiconductor equipment billings contracted 11% year-over-year to $25.6 billion in the third quarter, while quarter-over-quarter billings slipped 1% during the same period. (SEMI)

Bare PCB imports into the US soared to 151 million units in October, growing 49% compared with September. (IndexBox)

2024 semiconductor revenue will reach $632.8 billion this year, up 6% from 2023, with the US market remaining resilient from a demand standpoint and China’s recovery beginning by the second half. (IDC)

Three-fifths of businesses view generative artificial intelligence as a good opportunity but many fear they are exposed to cyberattacks. (PwC)

AI server shipments are expected to double in 2024, but while more PCB fabricators are entering the market, they don’t expect price competition yet. (DigiTimes)

Global semiconductor revenue is projected to grow 16.8% in 2024, to $624 billion. For 2023, the market declined an estimated 10.9% to $534 billion. (Gartner)

The PCB market will grow 4.9% year-over-year in 2024, driven by gradual improvement in demand for consumer products such as mobile phones, PCs and notebooks, plus new applications such as electric vehicles, AI servers and satellite communications. (Prismark Partners)

Revenues among the 40 leading PCB suppliers, which account for over one-half of industry sales, fell year-over-year but grew sequentially in Q3. Year-to-date aggregate revenues were down through September. (Prismark Partners)