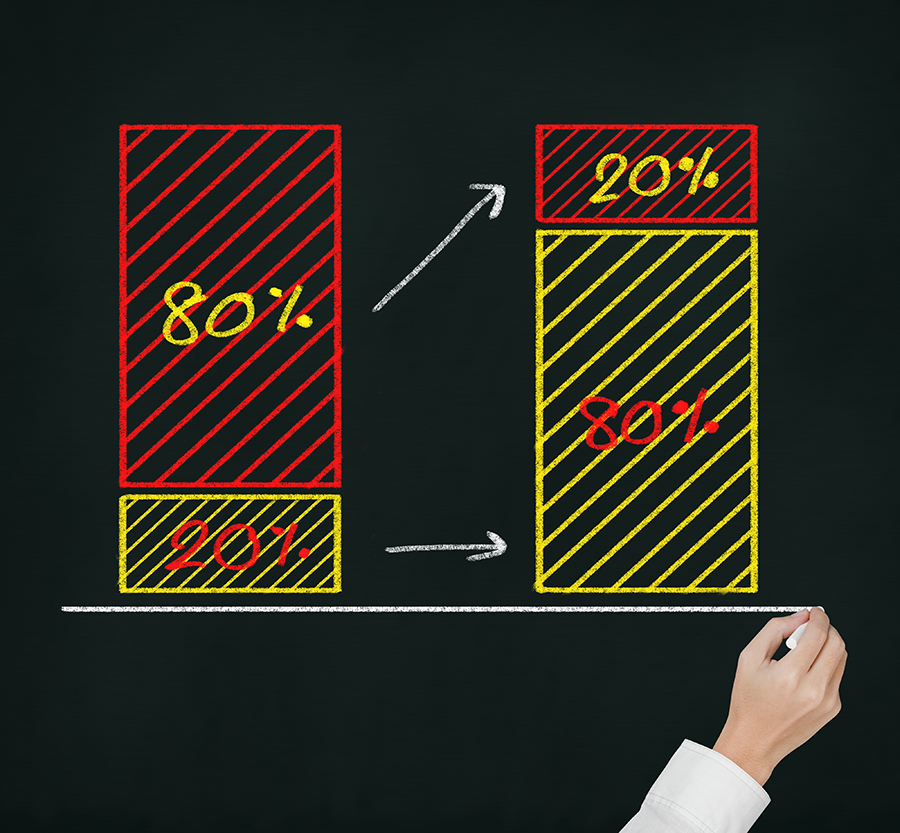

The 80/20 Rule

Don’t be afraid to drop bad fit customers.

Since tax season is upon us, I recently had a chat with my CPA. She is co-owner of one of the largest accounting firms in my area and I’ve done business with her for over two decades, so we discuss business strategy in addition to going over the numbers. This year, she mentioned they were planning to rationalize their customer base, eliminating those who tended to provide incomplete records right before critical deadlines. She saw these clients as problematic to her business for two reasons: they overloaded resources and their behavior increased the probability her team would make a mistake.

There is a parallel in the electronics manufacturing services (EMS) industry. Ask any longtime industry CEO and they will say 80% of their issues come from 20% of their customer base. Why do EMS companies keep bad fit customers? There are a number of reasons:

- A long-term customer hasn’t evolved as the EMS provider has grown and no one has analyzed the cost to continue to service it

- The project or division is part of a larger more attractive piece of business and taking the bad fit business is necessary to keep the good fit business

- Business is down and the EMS company doesn’t want to lose any customers

- The company is expected to grow or outsource more attractive business if its initial needs are handled well, but that better business never gets awarded

- No one is analyzing whether accounts are a good or bad fit.

It isn’t unusual for OEMs to outsource a basket of good fit and bad fit business so in cases where the problem project is part of a larger, more attractive project, it is better to keep the bad fit business. Similarly, there are situations where a smaller piece of business is the path to the larger piece of business.

My accountant’s observations also apply in this situation, however. When an account is exceptionally problematic it consumes resources, leaving fewer for customers that are better fits. Potentially, this often-reactive resource drain may result in program teams disappointing a good account with far more growth potential. The odds of quality issues in a problematic customer are also higher, particularly if inability to forecast is forcing expedites that must be purchased through gray market sources. The cost to service problematic customers is also higher and often those costs are never captured.

How do you address this trend?

First, program managers should analyze accounts for fit with the business model at least annually. Accounts that seem to fall outside good fit business trends in terms of volumes, profitability and customer behavior should be more closely evaluated.

- What changes would make this account more attractive?

- Is there a potential for growth in value-add or growth in total business?

- Is there a way to coach the customer in better forecasting or planning practices?

- Would product lifecycle management (PLM) or design for excellence (DfX) recommendations help eliminate some of the issues?

- If the account is expected to grow over time, how long will it take?

In short, the analysis should evaluate the potential for the business relationship to improve and set action items and a target date for when those improvements would begin to happen. If no improvement is possible and losing the customer wouldn’t put a larger account at risk, the next step would be determining how best to disengage.

This is an important decision. There are multiple options:

- Discuss the business fit issue with the customer and introduce them to a better fit EMS option

- Raise pricing until they leave

- Put the project at lower priority in the factory and let late deliveries incentivize them to leave

- Give them a deadline to leave.

Interestingly, the last three options are the most common ways EMS providers use to get rid of bad fit customers. The problem is that they damage your brand. Sourcing managers move among companies, and they have long memories, particularly if they felt that an EMS company treated them badly when disengaging. This is particularly true when a deadline to leave doesn’t give them time to find a new source and create a transition plan. Some EMS providers even have a reputation for welcoming all types of business in market downturns and then triaging the bad fit accounts when the economy improves.

Bad fit accounts are a lose-lose situation: bad for both the EMS provider and customer. The best way to avoid them is to screen prospective customers against a definition of what a good fit account looks like, set clear expectations about the relationship during the sales and NPI processes, and work with the customer to correct problematic behavior when it first begins. If fit issues become unresolvable over time, try to initiate a disengagement process that works for the customer.

Susan Mucha is president of Powell-Mucha Consulting Inc. (powell-muchaconsulting.com), a consulting firm providing strategic planning, training and market positioning support to EMS companies and author of Find It. Book It. Grow It. A Robust Process for Account Acquisition in Electronics Manufacturing Services. She can be reached at smucha@powell-muchaconsulting.com.