Dips and Dumps: Electronics Industry Wary of Demand, China

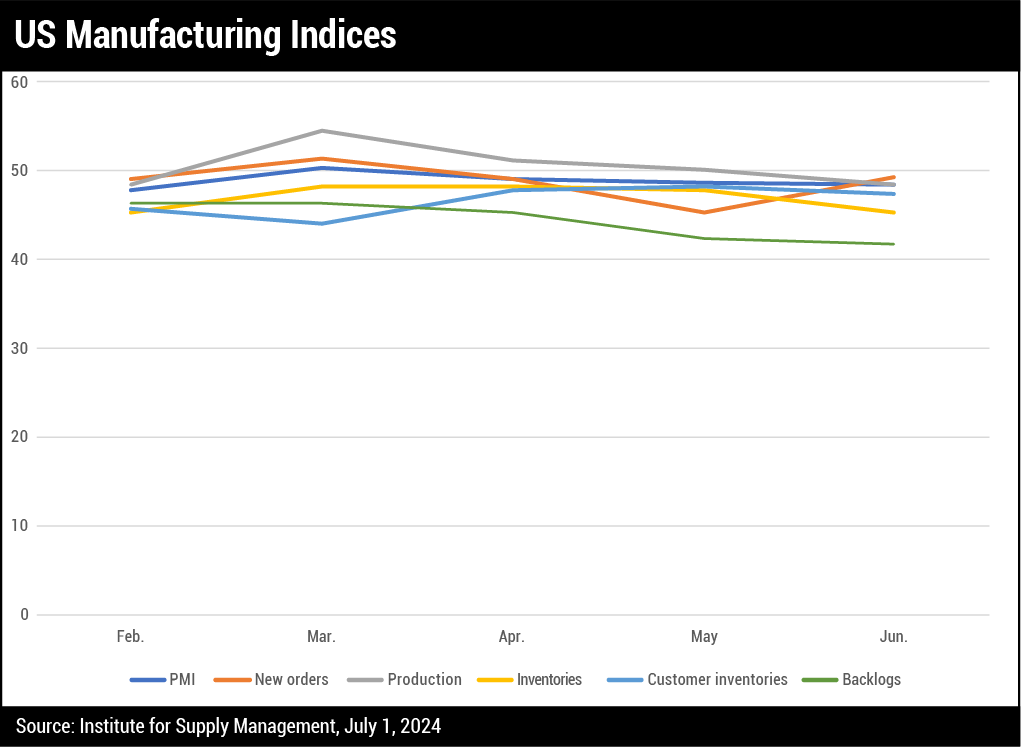

BANNOCKBURN, IL – Sentiment among electronics manufacturers fell in June but remained above its long-term average, according to IPC’s monthly supply chain report. Respondents noted concerns over possible dumping practices by Chinese companies.

The industry outlook remains strongly positive, though it has slightly softened over the two months from a record high in March.

The results are based upon the findings of an IPC survey conducted between May 15 and May 31.

Some 68% of manufacturers expressed “somewhat” or “extreme” concern over the possibility of Chinese manufacturers dumping components including PCBs at artificially low prices over the next year to stimulate its economy. Twenty-nine percent of respondents indicated dumping concerns from manufacturers operating in Asia Pacific.

Regarding outlook for the next six months, electronics manufacturers expect both labor and material costs to come down slightly, while material costs are expected to remain relatively stable. Although backlogs and ease of recruitment are likely to remain challenging, manufacturers expect profit margins and capacity utilization to rise.

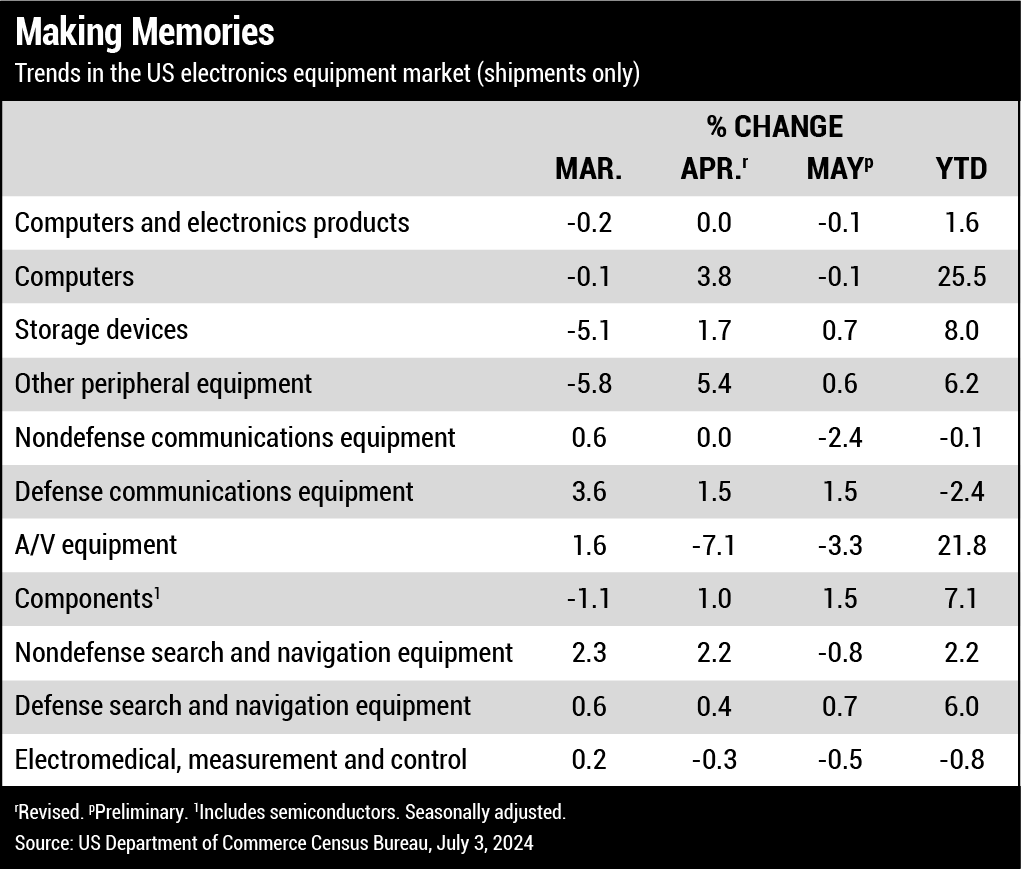

The survey revealed industry demand fell to its lowest level this year, with demand fundamentals falling for the third consecutive month, down 3.1% to the lowest level in 2024. The Shipments index fell one point, while the New Orders and Backlog indices each dropped two points. Capacity Utilization fell eight points and dropped into contractionary territory.

The Labor Costs index dropped two points but the Material Costs index increased six points, the latter to its highest level since August 2023.

Hot Takes

Sales of PCB and MCM design software rose 2.8% year-over-year in the first quarter to $378.9 million. The four-quarter moving average, which compares the most recent four quarters to the prior four, for PCB and MCM rose 13.2% (ESD Alliance).

AI server shipments in the second quarter will increase by nearly 20% sequentially, and the annual shipment forecast has increased to 1.67 million units, representing 41.5% growth year-over-year. (TrendForce)

Second quarter PC shipments rose 1.9% from a year ago to 60.6 million units, the third consecutive quarter of year-over-year growth. (Gartner)

Global semiconductor manufacturing equipment sales by OEMs are forecast to set a record, reaching $109 billion in 2024, growing 3.4% year-on-year. (SEMI)

Traditional PC shipments reached 64.9 million units in the second quarter, up 3% year-over-year growth. Excluding China, worldwide shipments grew more than 5%. (IDC)

Global semiconductor sales hit $49.1 billion during May, an increase of 19.3% year-over-year and 4.1% sequentially. (SIA)

The Indian EMS industry is expected to touch almost $300 billion by 2026-27. (Dixon Technologies)

The electronics industry in India has urged its government to consider reducing tariffs on inputs in the upcoming budget to bolster local manufacturing and enhance competitiveness against China and Vietnam. (India Cellular and Electronics Association)

Global smartphone shipments increased 6.5% year-over-year to 285.4 million units in the second, the fourth consecutive quarter of shipment growth. (IDC)

Worldwide IT spending is expected to total $5.26 trillion in 2024, up 7.5% from 2023. (Gartner)

Total copper-clad laminate sales in 2023 were $13 billion, including prepreg but excluding mass laminate – down 16% from 2022. Some 650 million sq. m. of rigid laminate materials were produced, including paper, composite, FR-4, and specialty laminates/other, a slight decrease from 2022. (Prismark Partners)

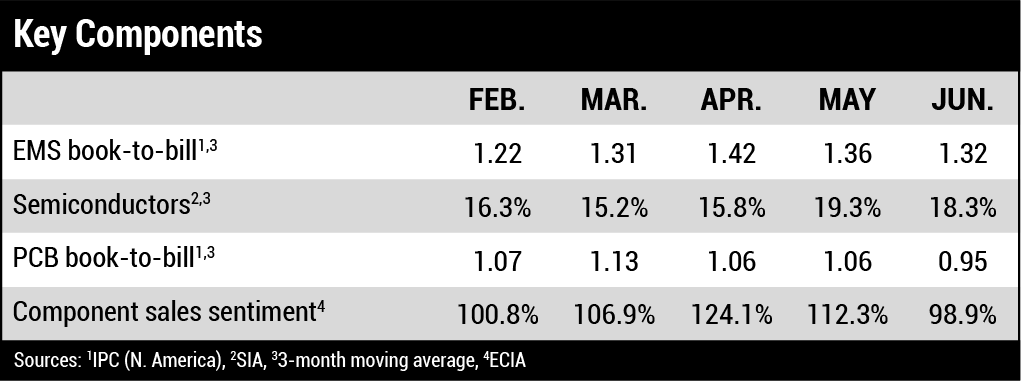

North American PCB bookings in June were down 2.7% year-over-year and up 3.2% sequentially. PCB shipments were up 1% over last year and 9.1% sequentially. (IPC)

North American EMS shipments in June fell 2.4% from last year and 3.3% sequentially. Bookings dropped 3.5% and 2.8% respectfully. (IPC)