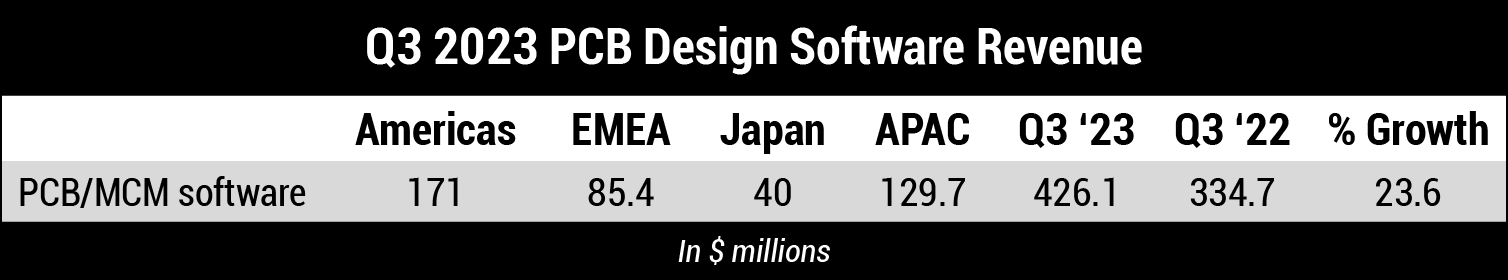

PCB Design Tool Sales Set Record in Q3

MILPITAS, CA – Sales of design software for printed circuit boards and multichip modules rose 23.6% to $426.1 million in the third quarter 2023, the ESD Alliance announced in January.

The four-quarter moving average, which compares the most recent four quarters to the prior four, rose 14%.

Electronic design automation industry revenue rose to $4.7 billion, an increase of 25.2% from 2022, and the four-quarter moving average rose 13.8%.

“Electronic design automation (EDA) reported record revenue growth in Q3 23,” said Walden C. Rhines, executive sponsor of the SEMI Electronic Design Market Data report. “This was the highest overall growth since Q4 1998. The computer-aided engineering, IC physical design and verification, printed circuit board and multichip module, and semiconductor intellectual property categories reported double-digit growth. Further, all geographic regions reported substantial growth.”

The companies tracked in the EDMD report employed 59,737 people globally in the third quarter, a 10.6% jump over 2022 and up 1% sequentially.

By product category, CAE revenue increased 22.4% to $1.7 billion and the four-quarter moving average increased 16.7%. IC physical design and verification revenue surged 45.3% to $904.5 million, with the four-quarter moving average increasing 29%.

Semiconductor intellectual property (SIP) revenue increased 22.1% to $16 billion. The four-quarter SIP moving average rose 5.3%. Services revenue slipped 3.9% to $138.3 million, and the four-quarter Services moving average rose 6%.

By region, the Americas procured $1.98 billion of electronic system design products and services in Q3, a 22.8% jump. The four-quarter moving average for the Americas rose 11.2%. Europe, Middle East, and Africa (EMEA) came in at $551.1 million, up 21.5%. The four-quarter moving average for EMEA grew 13.4%. Japan’s demand rose 30.5% to $309.3 million, with the four-quarter moving average rising 9.4%. And Asia Pacific procured $1.86 billion, up 28.1%, with the four-quarter moving average growing 17.8%.

Hot Takes

Worldwide semiconductor revenue in 2023 totaled $533 billion, a decrease of 11.1% from 2022. (Gartner)

Global smartphone shipments declined 3.2% year over year to 1.17 billion units in 2023. (IDC)

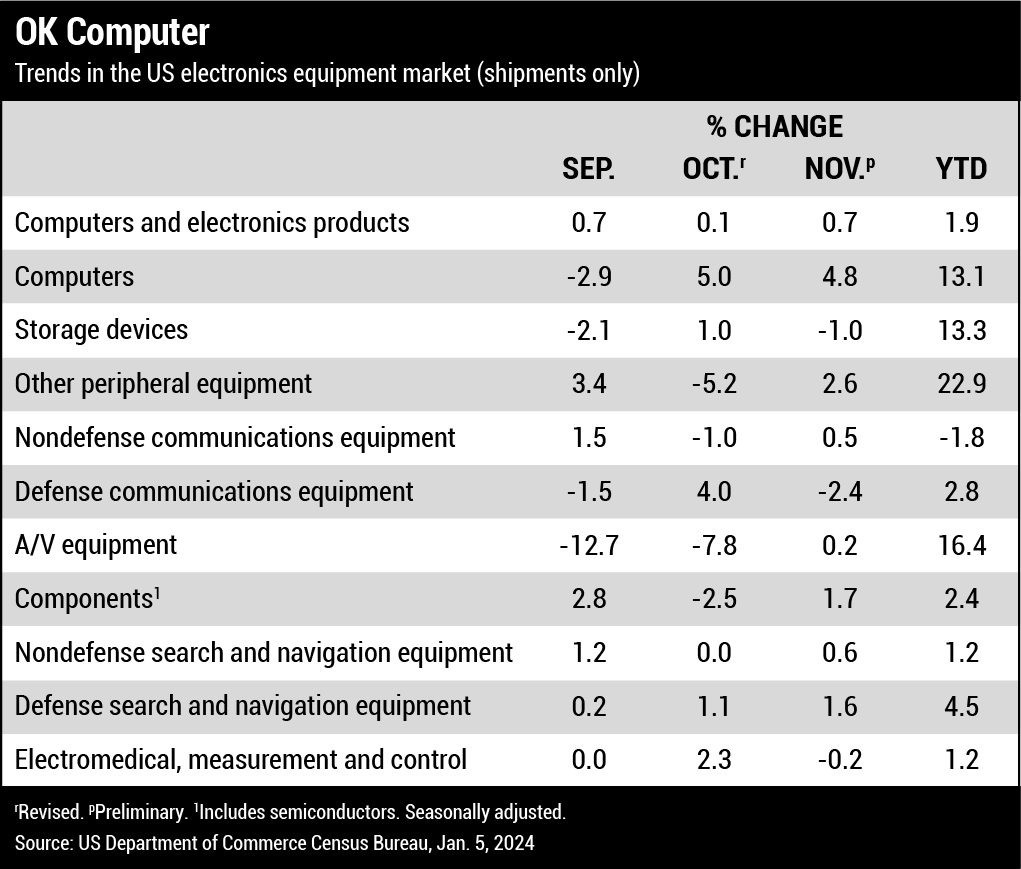

North American electronics manufacturing services shipments in December rose 1.3% over last year and 6.2% sequentially. Bookings fell 7% year-over-year and increased 2.3% sequentially. (IPC)

Worldwide IT spending is expected to rise 6.8% year-over-year to $5 trillion in 2024. (Gartner)

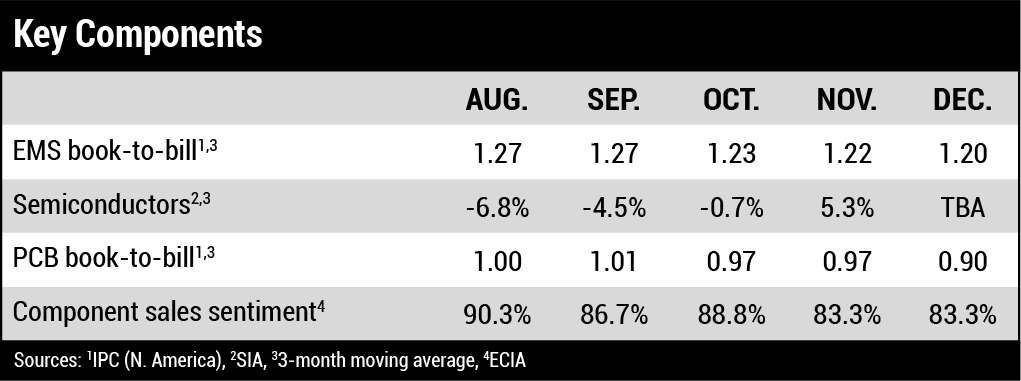

The downswing of DRAM contract prices, which had lasted for eight consecutive quarters since Q4 2021, reversed in the December quarter. (TrendForce)

A reduction in input tariffs could increase India’s smartphone exports to $39 billion by 2027 from $11 billion in 2023. (India Cellular and Electronics Association)

Global investments in space startups jumped 31% sequentially in the fourth quarter. (Space Capital)

Despite facing a traditional low-demand season, buyers are continuing to increase their purchases of NAND flash products to establish safe inventory levels. (TrendForce)

North American PCB shipments fell 18.3% in December from a year ago. Bookings dropped 28.7% from 2022 and were down 14.1% compared to November. For the year, orders fell 10%. (IPC)

About 4,500 tech industry jobs have been lost so far in 2024, and tech job unemployment is 2.3%. (Layoffs.fyi, CompTIA)

The medium-term outlook is for continued resilient expansion in the APAC region, with robust domestic demand in many Asian emerging economies, supported by their global competitiveness in the electronics manufacturing supply chain. (S&P Global Market Intelligence)

Passive component manufacturers predict a market rebound after the second quarter and into the second half of this year. (DigiTimes)

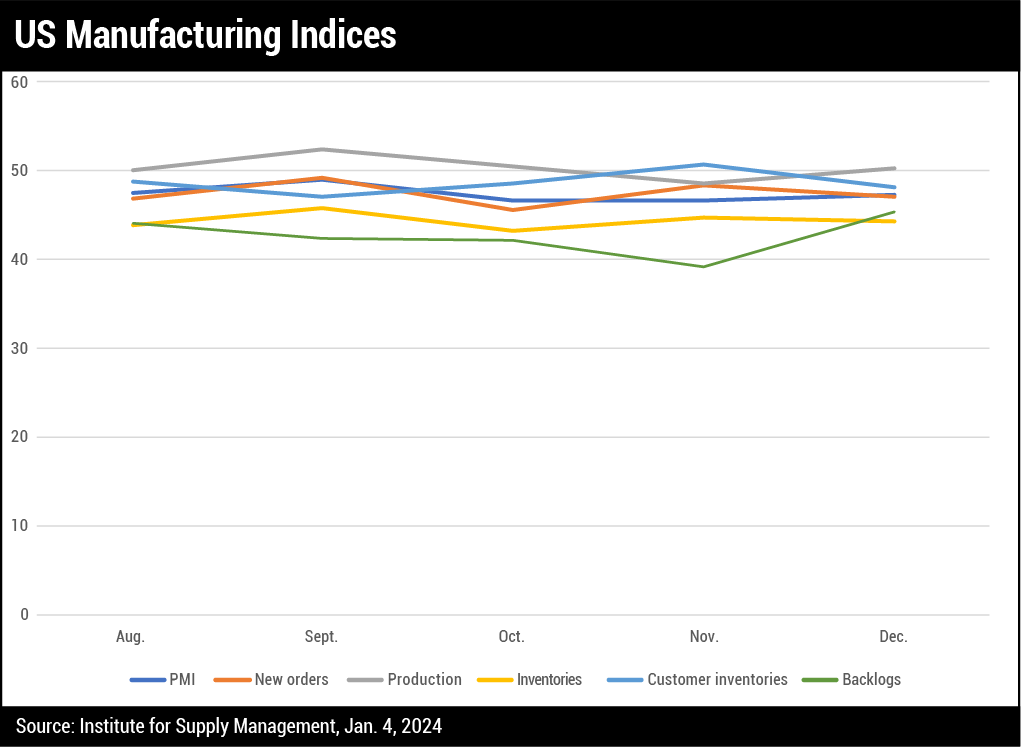

Electronics industry sentiment took a dip in December with new order, shipment, and backlog indices falling, with only capacity utilization index holding steady. Despite the dip, overall demand sentiment remained in positive territory. (IPC)

Worldwide PC shipments plunged 14.8% year-over-year in 2023, totaling 241.8 million units. (Gartner)

Shipments of traditional PCs fell 2.7% to 67.1 million PCs in the fourth quarter. (IDC)

The French government is looking to create 18,000 jobs in the electronics sector in 2024. (France Ministry of the Economy, Finance and Industrial and Digital Sovereignty and the Ministry of Higher Education and Research)