Nothing Soft about PCB Design Tools Market

Even after a long growth streak, observers still think the industry has life ahead.

by Mike Buetow

The Electronic Systems Design Alliance in October reported yet another staggering quarter for printed circuit board design software sales. Revenues were not only up big year-over-year, but a look at the longer-term historical trends shows just how far the sector has come even in the past few years.

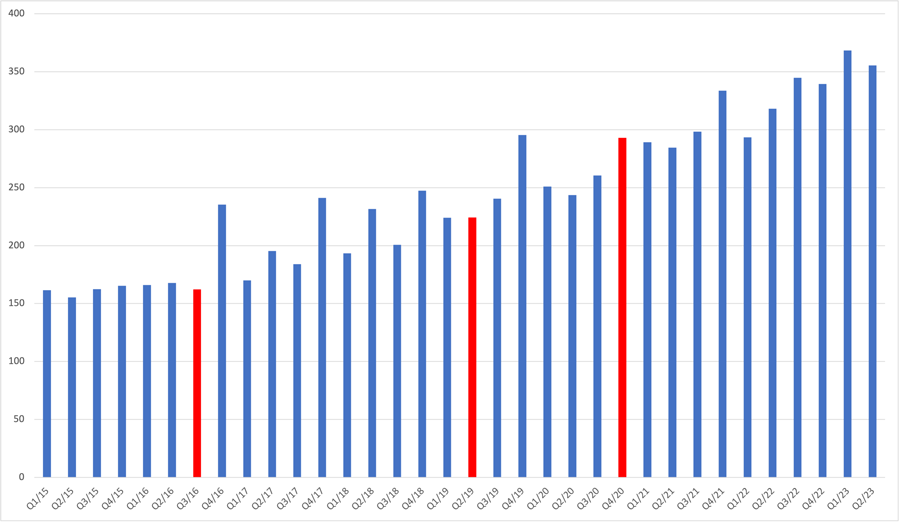

Indeed, over the past seven-plus years, this supposedly mature market has experienced a year-over-year quarterly drop only thrice – in the periods ended September 2016, June 2019 and December 2020 – two of which came during the Covid pandemic. Year to date, revenues are up almost 12%. The June 2023 period, the most recent quarter for which data are available, marked the second-highest quarterly figure, behind the March 2023 period (Figure 1). (The September quarter data are due to be released this month.)

To better understand the sustained gains, and – as important – whether industry-watchers think they will continue, we polled key figures at some major EDA companies.

To understand what’s lifting the market, we first must look at what defines the market. The ESD Alliance is an entity inside of SEMI, the semiconductor equipment and materials trade group. The Alliance focuses specifically on semiconductor and PCB design tool developers. The majority of the quarterly data reflects mostly that of Alliance members, but data for public companies also are included.

Among the PCB software companies included are Altium, Ansys, Cadence, Keysight, Siemens and Zuken, among others. The number of companies that report that are not part of ESDA is not substantial. In short, the ESDA data offer a better-than-solid picture of what’s actually going on in the marketplace.

Then there’s the results themselves. PCB tool sales over the most recent four quarters topped $1.4 billion, an industry record. If anything, revenue growth has been accelerating, rising 13% for the four quarters ended June 2023. Even longtime industry-watchers have taken notice.

According to the dean of PCB design tools market analysis, Merlyn Brunken of Siemens, the growth streak is “remarkable,” adding that of the three down quarters over the past eight-plus years, two came during the pandemic and none of them showed a year-over-year drop of more than 1%.

Brunken believes several simultaneous factors are contributing to the rise. He points to a general expansion of design around the world over the past two decades, in particular, in Asia.

Going back to 2005, when the ESD Alliance first broke out the PCB market segment revenue regionally, North America (37%), Europe (25%) and Japan (23%) dominated. But while North America’s portion has grown over time to 43%, the other traditional major players have seen their shares erode. Europe dropped to 22% in 2022, and Japan plummeted to 12% (more on that in a moment).

Meanwhile, Asia/Pacific, which accounted for some 16% of the PCB design tool regional market share in 2005, now makes up almost a quarter (23%) of worldwide revenue.

So more regional players have made their presence felt, expanding the playing field. But even as the field becomes wider, it’s also getting bigger. And there is widespread agreement that this boils down to the proliferation of electronics, both in new end-products (think IoT and consumer handhelds like watches) and in traditional ones where the content is growing (automotive and medical, for two).

As Bob Potock, vice president of marketing at Zuken USA says, “The simple answer is that more and more new products now contain some sort of electronics and that requires a PCB.”

Manny Marcano, chief executive of EMA Design Automation, perhaps the world’s largest value-added reseller of PCB EDA tools, agrees, adding the expanding amount of electronics content in products and the drive for “smaller, faster, cheaper, lower power products … are enabling the market to grow as companies are turning to software and automation to meet these market requirements.”

“You only have to check the statistics on the number of 5G devices approved to connect to wireless networks globally to realize that many require complex, high-speed circuit boards,” says Brunken. “6G work is already underway. On top of that, you can look at all of the global design activity in the computer space, with many more companies now producing unique, high-speed MPUs, GPUs, and AI processors and the circuit boards that include those devices. These new devices are no longer restricted to the traditional computer market as industries adopt similar devices for automotive, communication, aerospace, defense, and other applications. These new devices are increasingly designed by systems companies that create custom PCBs instead of using an off-the-shelf circuit board.”

“Macro trends like always-on connectivity and new business models for customers who are not only looking to sell products but monetizing and leveraging the data collected (meaning they need intelligence and sensors to collect the data) are also playing a big role in this growth,” Marcano adds.

For some, the current upcycle recalls the boom era of the personal computer, perhaps the fastest-growing time in industry history. According to Marcano, “I think this era is similar to when EDA first really started in terms of the amount of design activity and change in the market.” He and Brunken agree that the time-to-market pressures coupled with more complex designs necessitate levels of automation that will continue to drive new sales.

“Design engineers are typically a risk-averse group, especially with tools they learn and use daily. They add tools and change methodologies when they have to make a change to get the job done correctly. The reality is that complexity drives PCB engineers to adopt new or more capable tools to achieve the project goals,” said Brunken. “What is unique right now is that the industry has to deal with so many complex technology issues converging simultaneously. Complexity changes are happening across several dimensions. The only time I can recall something like this that lasted an extended period was when automation emerged and forced teams to move from manual methods to tool adoption. And they did it because they couldn’t be successful with the old techniques that they were used to.”

Added Marcano, “I also think we are in somewhat uncharted waters. At PCB West your keynote speaker stated that in North America alone there are 70,000 PCB design openings and only 10,000 filled jobs. If we combine that with your recent PCB salary survey showing 46% of active designers surveyed are over 50, what we have is a massive labor gap coming like we may have never seen before. Minting new engineers will take time and the way companies will need to solve this is to lean on automation and tools more than ever before, so although the current growth has been amazing, we are even more bullish about what lies ahead. Tremendous opportunities for those who can innovate and help meet these needs.”

Chicken and Egg

But do new tools drive growth, or is it more a function of new program starts and growth at customers? Marcano thinks the answer is both. “We are seeing an increase in new projects and companies – and segments, electric vertical take-off and landing (eVTOL) aircraft (Figure 2), for example – but we are also seeing existing customers needing more capability to meet their requirements, partially based on the staffing challenges defined above but also to help them meet the complexity, and supply-chain requirements that they have as well.”

Potock points to new component technology, such as MEMS, FPGA, IoT and touchscreens, that is enabling product line extensions and new markets. “An example of product line extension would be a smart refrigerator with touchscreen. An example of a new marker would be wearables in the fitness industry,” he said.

“The emergence of new technologies and requirements is the primary driver of growth in EDA,” Brunken agrees. “I think new program starts and customer growth are part of the equation, especially with the ‘electrification of everything.’ At some point, technology will drive beyond old methodologies, and tools capable of making the design team successful will be incorporated. A great example of this can be found in the integration of more simulation and analysis tools into the PCB design flow.”

Employment for All?

On the PCB Chat podcast each quarter, ESD Alliance spokesperson Wally Rhines has often noted that if the growth rate in EDA is sustained, the industry will sooner or later employ most of the world. Indeed, employment in the EDA sector was up nearly 12% year-over-year in the June quarter. It begs the question, how sustainable is this?

“It’s remarkable to me that we are growing the employment that rapidly, although we almost always grow employment faster than the revenue,” said Rhines, who is also former chief executive of Mentor Graphics. “We may be hiring more people in lower-cost jurisdictions and as a result the headcount goes up but the cost of hiring all those people doesn’t go up quite as much. It’s a very healthy and growing industry.”

Brunken cautions that the employment data may not tell the whole story. The data are based only on corporate headcounts, and there’s no ratio of employees to expenses. “It would be unwise to grow expenses faster than you are producing revenue,” he notes. “That becomes self-limiting pretty quickly.

“Depending on the timeframe you look at, the CAGR will vary. In the EDA market, between 2016 and 2022, EDA revenue grew by 10%. However, we have seen from our earlier analysis that much of the revenue growth comes from the Asia/Pacific region where expenses are not the same as those in Europe, North America and Japan. And, even for companies headquartered in Europe and North America, there has been an effort over the years to go to where the talent is or to help address the labor shortages at home. Frequently, the full-time employee count can be less expensive. Therefore, I would argue that headcount growth is a non-issue when considering revenue growth and headcount expense.”

Tools will drive revenue, Marcano says, and the jobs will follow the need for new tools. “While how AI will impact the market remains to be seen, it opens whole new areas of need for companies to develop and leverage these learning models and large data sets AI needs to be successful. To achieve that goal, the core content of CAD libraries, simulation models and references designs are required for AI and MBSE (model-based systems engineering). I think the recent history has shown that as long as we can continue to derive significant value for customers, they are willing to invest and we will need to staff accordingly to meet those needs.”

AI is, of course, all the rage, but rarely is a single technology a panacea. Where else might tomorrow’s growth come from? According to Brunken, we might just need to think small: “We are just entering the packaging market’s growth stage. Packaging has always been part of the PCB category and gets reported separately across several categories, including physical layout, analysis, and packaging tools. The analysis and packaging tools have CAGRs of ~12%, with the physical layout tools just over 9% during the 2016–22 timeframe.” As major legislative packages such as the Chips and Science Act in the US and the European Chips Act take hold, new investments – both public and private – could spur yet another round of expansion for PCB tools.

The other question is whether another region will emerge as something more than a bit player. The decline of Japan, which has suffered in part because its traditional product mix hasn’t grown as fast as the electronics produced in North America and Asia/Pacific, proves that dominance isn’t forever. That should serve as both a motivator and a warning to the rest of the world not to get complacent. ![]()

Mike Buetow is president of the PCEA (pcea.net); mike@pcea.net. Each quarter he discusses the latest EDA data with ESD Alliance spokesperson Wally Rhines on the PCB Chat podcast.