Supply Chain Productivity Declines Cannot be Solved by Robots and AI Alone, Gartner Says

New technologies ranging from smart robotics to actionable AI have the potential to transform the supply chain function, but they will fail to lift historically low levels of labor productivity unless utilized as part of a broader strategy, according to research firm Gartner.

“There is legitimate excitement today around new technologies that hold out the promise of vastly enhanced organizational productivity,” said Thomas Pocock, senior director, advisory, in Gartner’s Supply Chain Practice. “Supply chain leaders must remember that these new technologies require the partnership of an engaged and productive workforce for these gains to be realized. Unfortunately, the data tell a discouraging story on this front.”

Pocock highlighted data from a first quarter Gartner survey when 2,613 supply chain employees were surveyed to show the extent of supply chain’s labor productivity challenges:

- Only 25% of the supply chain workforce is fully engaged.

- Turnover is 33% higher in the supply chain function than pre-pandemic.

- Only 16% of the supply chain workforce is willing to go “above and beyond” in their roles.

“Introducing new technologies, especially of the magnitude of AI or smart robots, would come with implementation challenges at any time,” said Pocock. “Any new technology introduced in this environment is likely to be met with elevated levels of mistrust and change fatigue. It’s clear there needs to be a new strategy to make such integrations work for all sides.”

Pocock noted that technology is just one of a series of strategies that need to be reinvented to reverse supply chain’s labor productivity slide. He recommended chief supply chain officers reexamine their approaches in three key areas:

Integrating technology and people strategies. New workplace technologies should be designed with the human-technology relationship front and center. Organizations must also create opportunities for reciprocal learning, or the opportunity for employees to safely make sense of new technology and see how technology is incorporating human input. Technology investments must be made side-by-side with equivalent investments in workforce training, skills development and knowledge curation.

Individual talent management. High-demand skills are often already available in supply-chain organizations but often trapped by the rigid nature of job descriptions. CSCOs can unlock more skills and flexibly deploy talent where it is needed by breaking down projects into component tasks and seeking skills needed for those tasks across the entire organization and even beyond it.

Organizational design. Organizations can leverage crisis situations and market opportunities as a reason to break down silos and find new, more efficient organizational structures. Spontaneous redesign of decision-making processes happened at many companies during the initial disruptions of the Covid era. They can be harnessed to build resiliency in the face of new challenges, such as persistent inflationary conditions or changing geopolitical considerations.

Hot Takes

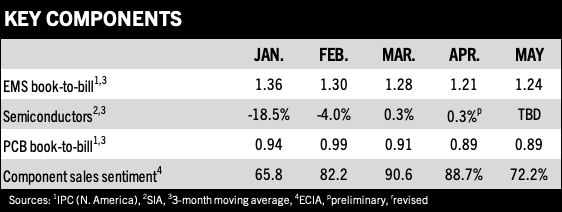

Total North American EMS shipments in May were up 7.1% compared to last year. Shipments decreased 5.2% from April. Bookings increased 0.8% year-over-year and 4.4% sequentially. (IPC)

Global PC and tablet shipments will fall to 385 million units, down 15% compared to last year. (IDC)

Global tin prices have leveled as inventories build and demand slows. (Reuters)

Production volume of smartphones was 250 million units in Q1, a 19.5% year-over-year decrease and the lowest output since 2014. (TrendForce)

North American PCB shipments rose 6.7% year-over-year in May and fell 1.9% sequentially. Bookings were up 4.1% over last year and 6.7% versus April. (IPC)

Taiwan’s exports of chips to the US rose for the 26th consecutive month in May, defying a downturn in the global semiconductor market. (Taiwan Ministry of Finance)

Global semiconductor materials revenue grew 8.9% to $72.7 billion in 2022, surpassing the previous market high of $66.8 billion set in 2021. (SEMI)

Global shipments of LCD monitors fell 7.4% sequentially and 21% year-over-year to 28.8 million units in the first quarter. (TrendForce)

Global 300mm fab equipment spending for front-end facilities is expected to grow to a record high $119 billion in 2026 following a decline in 2023. (SEMI)

AR/VR headset shipments slowed 54% year-over-year in the first quarter. (IDC)

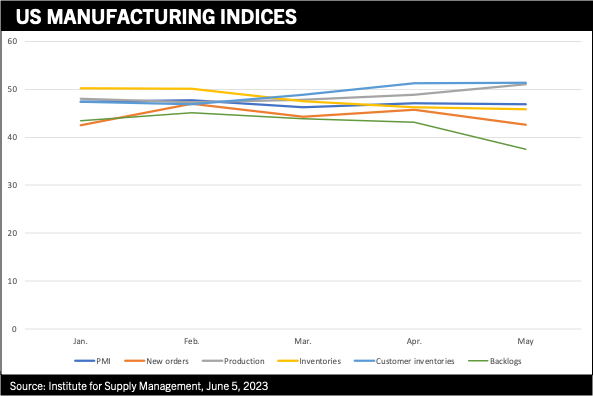

Semiconductor industry contraction likely moderated in the June quarter and a gradual recovery is starting in the current quarter. (SEMI)

Smartphone shipments will decline 3.2% in 2023, totaling 1.17 billion units for the year. (IDC)