Tariff Tradeoffs

Buoyed by the US-China trade war, Mexico and Malaysia are making their move.

by Mike Buetow

On Jan. 6, 2023, the Wuxi Welnew Microelectronics plating plant in Wuxi, China, was decimated by a fire.

You’ve probably never heard of Welnew. It is a supplier of electroplating (Sn, SnBi, SnCu, L/F Ag, ZnNi, and so on) to a host of semiconductor manufacturers including Infineon, Vishay, Bosch, Osram, Onsemi, Renesas, Toshiba and others. Welnew is critical to the supply chain: It claims a 60% market share for plating parts ranging from Mosfets, RF devices and LED drivers.

This happens in supply chains. If it’s not a typhoon, it’s a volcano. If it’s not a flood, it’s a fire. If it’s not an epidemic, it’s a pandemic. Lines and factories go down. Disruptions occur. Prices and lead times fluctuate, sometimes madly.

We bring this up to remind readers that, in electronics manufacturing services, the trend toward tighter supply chains and local vendors owes to a host of reasons, not just tariffs and infectious diseases. All of the above, it appears, is informing the geographical repositioning that is taking hold in the industry on a scale not seen since the late 1990s and early 2000s.

Over the past year, memory prices have dropped and component inventories have started to clear.1 Parts availability in almost all instances have ceased to be an issue. Yet prices for tin, copper, gold and other metals approached or surpassed all-time highs.2 Meanwhile, OEMs and EMS companies pared their order windows, giving suppliers less of a view of longer-term buying patterns. Relaxed pricing pressure on components – the leading driver of end-product costs – has for many companies had a downward effect on revenues.

Market Dynamics

The overall market for EMS and ODM services is estimated somewhere between $423 billion and $700 billion, depending on whom you ask. One of the fundamental reasons for the variance stems from how and when the data are counted. Some research firms conduct surveys and add up the results of every company they can count, regardless of where in the calendar their fiscal year starts and ends. Thus, for a company whose fiscal ends June 30 – for instance, Plexus – only 50% of its actual sales days fall inside the research window. In other cases, some ODMs are included while others inexplicably left out.

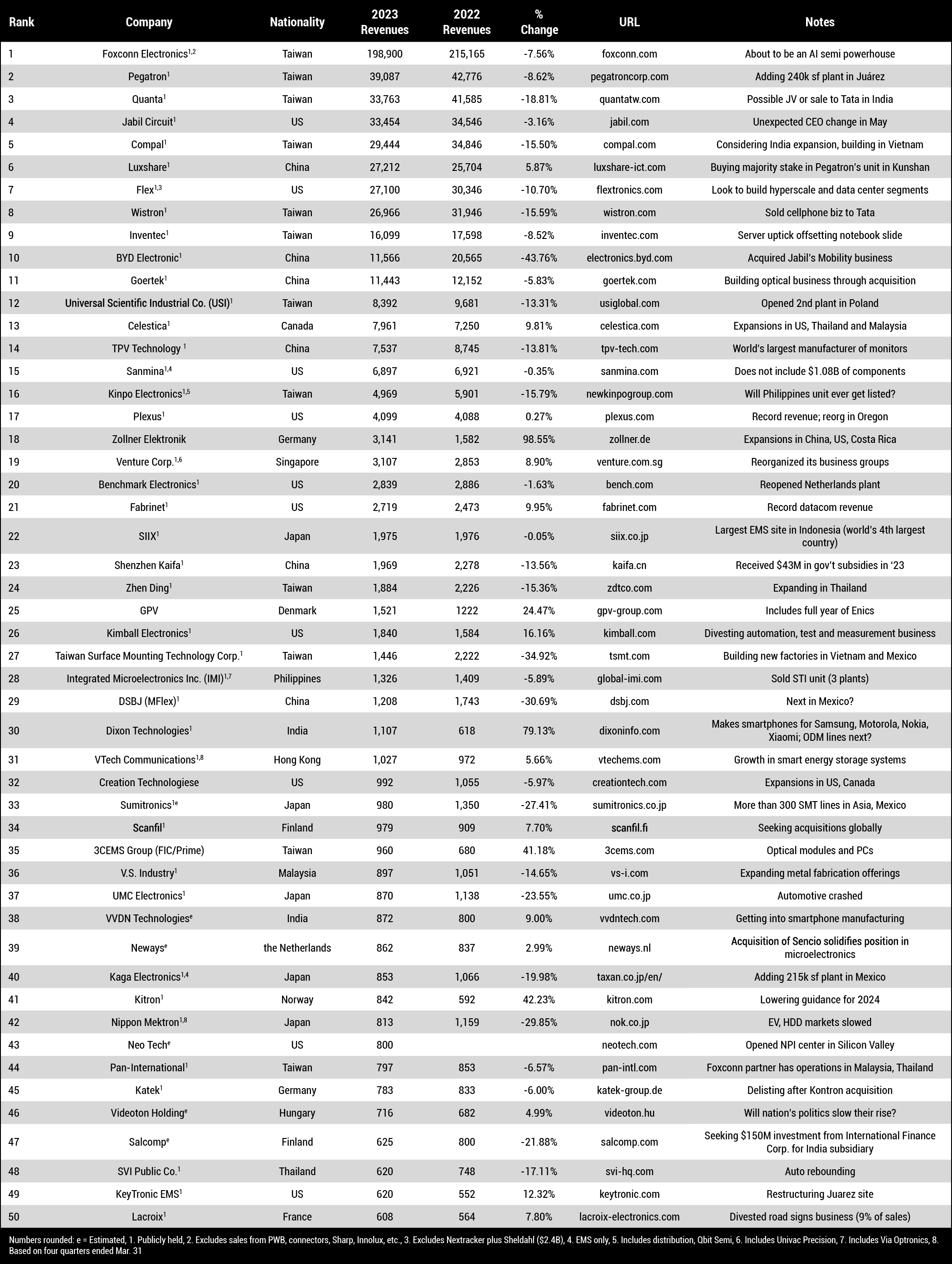

While we do not attempt to measure the total EMS/ODM market size, we do have a process for determining the financials of the individual companies included in the CIRCUITS ASSEMBLY Top 50. We have always attempted to dial in to the actual calendar year (January to December) and cast a wide net, under which Foxconn is included, as are its main competitors: Pegatron, Quanta and Compal, among others.

Malaysia and Mexico

China continued to take it on the chin in 2023. Tariffs and anti-dumping investigations by the US and EU, coupled with increased saber-rattling across the Taiwan Strait, has prompted more OEMs to look elsewhere for suppliers.

While India, Thailand and Vietnam take up most of the oxygen surrounding the migration from China, don’t overlook two other nations: Malaysia and Mexico.

New investment in the US has made major headlines, yet a bigger story is taking place south of the US border. Foxconn, Pegatron, Quanta, Jabil, Kimball, Vexos, Kaga Electronics, Neo Tech, GPV, OSI Electronics, TT Electronics, plus cable and wire harness makers like Sinbon Electronics and Lisconn are among those adding capacity south of the US border. India-based ODM VVDN Technologies has on its roadmap to expand to Mexico within the next 18 months. The forecast capacity additions total in the millions of square feet.

An ocean away, in Malaysia, Celestica, Kitron, TT Electronics, Neways, Aurelius Technologies and Entech Electronics are among the EMS companies adding capacity in and around Penang which, as suppliers like Texas Instruments, Ericsson, Bosch, Lam Research, TTM Technologies and AT&S also fuel the expansion boom there, is looking more and more like Silicon Valley East every day (Figure 1).

How the Data are Counted

Many reports on the market refer to various tiers of companies, typically Tier 1, II, III and IV (or micro). CIRCUITS ASSEMBLY uses broader definitions of these segments. We feel revenue is an obvious measure of classification, but hardly the only one. While the top tier firms are widely agreed upon, the middle tiers are harder to compare. For example, a single-site, privately held company is a very different animal from a publicly traded competitor with operations in multiple countries or regions, even if their revenues are similar.

For the purposes of the CIRCUITS ASSEMBLY Top 50 (Table 1), how the tiers are defined matters less than the revenue, which is the only metric we are using here. That said, we do not attempt to characterize the ranked firms by their business model. Some are dedicated to SMT assembly. Others offer design, fabricate various types of circuit boards or components, or provide engineering services and box-builds or sheet metal fabrication. A few self-brand their own products.

We don’t penalize companies for being either horizontal or vertical, even if they private label goods on behalf of someone else. The question we ask is, does it perform electronics assembly on behalf of third parties?

We do, however, attempt to rationalize the revenue for companies that offer services or products that are clearly outside the scope of electronics assembly. For instance, Sanmina, Zhen Ding Technology, Flex and Nippon Mektron all have board fabrication operations of varying sizes. Not all those firms report their bare board and assembly revenue separately. As such, we use an admittedly crude formula for reporting the EMS side of their respective businesses.

We call it “crude” because we are keenly aware of its inaccuracy. To wit, a camera module could contain an unpopulated flex circuit, whose value might be 15% of the total unit cost. The flex circuit in a cellphone board, by contrast, might be worth some 40% of the total cost, with components comprising another 40% and labor and equipment amortization the rest. But we have no way of knowing the product mixes of these multibillion-dollar players, and as such where the companies don’t break out their non-EMS sales, we apply a highly generic 40% assembly value to the overall sales of the flex makers.

That said, we do our best to exclude non-ODM/EMS revenue from the data. It’s not easy. Case in point: Jabil’s diversified approach ranges from traditional EMS and ODM work to materials science and development and health care devices. If we include just the EMS unit, calendar 2023 revenues were $15.1 billion, about 45% of its overall sales. The diversified manufacturing services unit, however, includes some degree of revenues that would otherwise be “EMS” had Jabil chosen a different reporting configuration.

Others provide a clearer delineation. Based on the prior year’s annual reports, we deducted 15% from Luxshare’s revenues to account for connector sales. We reduced Flex’s sales by $2.4 billion to account for its Nextracker (solar products) and Sheldahl (flex circuits and materials) subsidiaries. Something goofy is going on with Goertek’s financials: The Chinese ODM of smart electronics wearables and home devices reported exactly the same revenue and cost of sales in 2022 and 2023 for its precision components and “other business” segments. Impossible. We deducted 14% from its Top 50 figure to account for the component sales, but that has to be a mistake. The results of BYD, Kaga Electronics and Dixon Technologies are EMS only, not automotive, distribution, white goods or LEDs. DSBJ’s (M-Flex) figures are based on the 65% of its revenue that comes from PCBs, then weighted for (estimated) EMS value. There will be mistakes.

Currency Effects

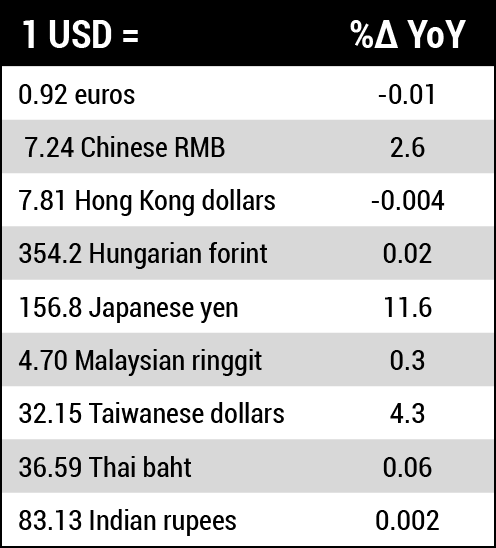

Currency effects always influence the rankings. The US dollar index in fall 2022 reached its highest point in nearly 20 years. It softened somewhat against some currencies in 2023 (Table 2). For those companies reporting revenues in non-US currencies, we converted the numbers using the averages set forth on May 27, 2024. Currency fluctuation will account for why some companies appear on some industry lists and not others. Likewise, CIRCUITS ASSEMBLY attempts in all cases to use the calendar year, not company financial years. Again, differing methodologies explain variances with other rankings.

Where’s Tata?

Tata Group, India’s biggest name in automotive, is a $150 billion behemoth. And while we noted in the past how Luxshare was quickly ascending the rankings using a model similar to that of Foxconn (including building for Apple), over time Tata Electronics might prove an even more effective climber.

Tata Electronics Pvt. Ltd. (TEPL) is a wholly owned subsidiary of Tata Group, India’s largest conglomerate. Incorporated in 2020, it made waves with its $131 million acquisition3 of Wistron’s 2.2 million sq. ft. iPhone assembly campus in India. Tata doesn’t break out TEPL’s revenue, however, and the business is also pushing hard into semiconductor fabrication, having committed at least $10 billion to the venture.4 This makes the enterprise similar in some respects to Foxconn, albeit considerably smaller as an ODM. We have seen some estimates value the offloaded Wistron business at $600 million, which seems reasonable. That revenue, however, was recorded by Wistron in 2023, as the deal did not close until October. As such, Tata is left off this list, although it almost certainly will join next year.

Other omissions often seen on other lists include Hana Microelectronics (half its overall sales of $710 million from were EMS, the rest from components); Deihl Controls ($606 million) just missed; Orient Semiconductor (OSE) ($515 million); Bitron (haven’t been able to separate the EMS portion of its $1.5 billion in overall sales); Melecs ($513 million) and PC Partner (mostly OEM sales). And we are admittedly confused by the inclusion of FIC/Prime/3CEMS as separate entities on some lists, as they are one and the same. Kinpo Electronics, which last year raised its stake in publicly traded Cal-Comp Electronics (Thailand) to 49.99%, reports the latter’s results in its consolidated financial statements. As such, the two entities are combined for the purpose of this list.

Acquiring Minds

Every year brings major – and usually unexpected – deals, and 2023 was no different. What was most surprising, perhaps, is how Asia-centric the M&A activity has become.

In addition to the aforementioned Wistron deal, Tata Electronics is reportedly in talks to buy Pegatron’s Indian iPhone manufacturing facility. It is Pegatron’s last iPhone factory, having sold a plant in China to Luxshare last year.

Jabil’s $2.2 billion sale of its mobility unit to BYD was the largest deal in terms of sale price, but over time, it may well take a backseat – pun intended – to the amassing of iPhone factories by Tata.

Not to be outdone, Dixon Technologies is reportedly in talks to acquire a majority stake in Transsion Holdings’ Indian unit as it looks to strengthen its presence in India’s smartphone market.

Lincoln International, a Chicago-based investment bank, tracks EMS deals each quarter. The firm reported 29 completed deals in 2023, but in our estimation that undercounts the actual number of transactions by at least half. That’s not a criticism: It’s tough to track everything, especially when so many companies are foreign-owned and private. To wit, Wistron and Ge-Shen were responsible for a half-dozen deals between them, and insofar as we can tell, none of them were accounted for by Lincoln.

Interestingly, of the initial public offerings in 2023, none was on Western exchanges. Avalon Technologies and Elin Electronics were listed on the BSE in India, JLC Technology Group (primarily a bare board fabricator) went public on the Shenzhen exchange, and Cape EMS was listed on the Bursa Malaysia board. SFO Technologies, which announced plans to list within the next two years, reported revenues of about $300 million.

Final Notes

The next business trend to watch for: EMS/ODMs investing in semiconductor operations. Foxconn’s plans are well known. But others, including Tata (semiconductors) Syrma (die), AST and Saharsa Electronics (packaging) are in planning stages or nearing production as well. Business models in EMS are always changing.

As always, any errors are those of the author.

References

1. SEMI, “2023 Global Semiconductor Materials Market Revenue Declines From 2022 Record High, SEMI Reports” May 6, 2024.

2. Harry Dempsey and Sally Hickey, “Rush of Fund Manager Interest Drives Metals Prices to Fresh Highs,” Financial Times, May 22, 2024.

3. Wistron, “Wistron Announces Q1 Financial Results,” May 13, 2024, https://www.wistron.com/en/Newsroom/2024-05-13.

4. Dia Rekhi and Aashish Aryan, “Tata Electronics Begins Export of Semiconductor Chip Samples from Bengaluru Centre,” ETtEch, May 8, 2024, https://economictimes.indiatimes.com/tech/technology/tata-begins-export-of-chip-samples/articleshow/109899909.cms

Mike Buetow is president of PCEA (pcea.net); mike@pcea.net.