Global Semiconductor Manufacturing Industry Poised for 2024 Recovery, SEMI Reports

MILPITAS, CA – The global semiconductor manufacturing industry recovery is taking hold with electronics and IC sales increasing in the final quarter of 2023 and more growth projected for 2024, SEMI announced in its fourth quarter 2023 publication of the Semiconductor Manufacturing Monitor (SMM) report.

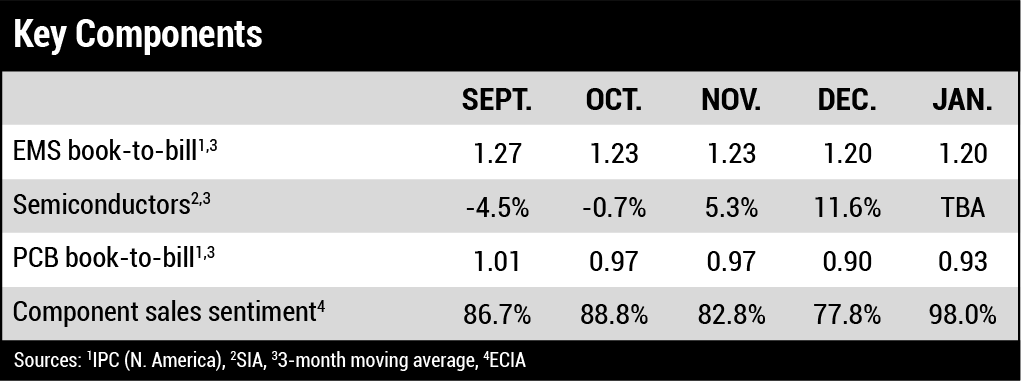

In Q4 2023, electronics sales edged up 1% year-over-year (YoY), marking the first annual rise since the second half of 2022, and growth is projected to continue this quarter with a 3% YoY increase. At the same time, IC sales returned to growth with a 10% YoY jump in Q4 2023 as demand improved and inventories started to normalize. IC sales are forecast to strengthen in Q1 2024 with 18% YoY growth.

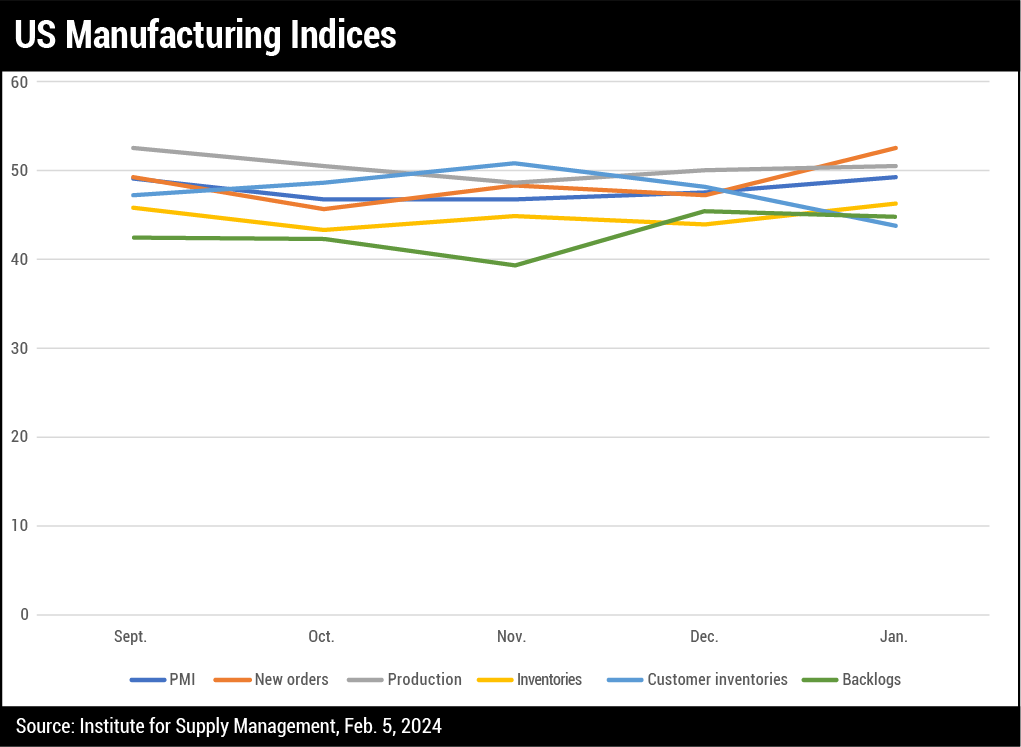

Capital expenditures and fab utilization rates are expected to see a mild recovery starting in Q1 2024 after significant declines in the second half of 2023.

In Q1, memory capex is projected to increase 9% quarter-on-quarter (QoQ) and 10% YoY, while non-memory capex is on track to climb 16% during the quarter but remain at lower levels than recorded in Q1 2023. Fab utilization rates saw a modest improvement from 66% in Q4 2023 to 70% in Q1 2024. Meanwhile, fab capacity grew 1.3% in Q4 and is projected to match those gains this quarter. Equipment billings in 2023 surpassed projections though growth is expected to be muted in the first half of 2024 mostly due to seasonality.

“The electronics and IC markets are recovering from a slump in 2023 with growth expected this year,” said Clark Tseng, senior director of market intelligence, SEMI. “Although fab utilization remains low at the moment, improvement as 2024 unfolds is anticipated.”

“Semiconductor demand is well on its way in the recovery,” said Boris Metodiev, director of market analysis at TechInsights, which assisted in the report. “While the overall IC market is growing this year, slowing automotive and industrial markets are hampering the analog expansion. AI will be a huge catalyst for leading-edge semiconductors as the technology proliferates from the cloud to the edge. At the same time, geopolitics is driving excess capacity at the trailing edge.”

Hot Takes

Global PCB output value in 2023 will total $73.9 billion, a decline of 15.6% from 2022, but is expected to rebound in 2024 to total $78.2 billion. (Industrial Technology Research Institute)

Worldwide tablet shipments declined 17.4% year-over-year in the fourth quarter, totaling 36.8 million units. (IDC)

Demand for low-loss materials for 5G applications is expected to surpass $2.1 billion by 2034. (IDTechEx)

Global semiconductor sales totaled $526.8 billion in 2023, a decrease of 8.2% from the record 2022 total of $574.1 billion. (SIA)

North American EMS shipments in January were up 2.6% compared to the same month last year. Sequentially, shipments decreased 2.7%. Bookings fell 12% year-over-year and decreased 2.2% sequentially. (IPC)

Shipments of AI PCs – personal computers with specific system-on-a-chip (SoC) capabilities designed to run generative AI tasks locally – grew from nearly 50 million units in 2024 to more than 167 million in 2027 and will represent nearly 60% of all PC shipments worldwide. (IDC)

Copper clad laminate, PCB and ABF substrate orders have increased with ChatGPT significantly boosting demand for AI servers. (DigiTimes)

Significant semiconductor revenue growth is expected in 2024 of 12%, followed by even stronger growth in 2025 of 21%. Moderated growth is anticipated in 2026 as the market enters a downcycle later that year. (TECHCET)

The world’s top five semiconductor equipment manufacturers’ latest financial reports signal a surge in demand for advanced manufacturing equipment and positive signs of industry recovery. (TrendForce)

Taiwan-based notebook ODMs, several of which experienced sequential shipment decreases in January, are expected to witness a pickup in March shipments. (DigiTimes)

North American PCB shipments fell 3.9% in January from a year ago, and fell 7.9% sequentially. Orders dropped 8.6% year-over-year and rose 11.1% from December. (IPC)

Worldwide silicon wafer shipments in 2023 decreased 14.3% to 12.6 billion square inches while wafer revenue contracted 10.9% to $12.3 billion over the same period. (SEMI)

DRAM demand bits remained low during the memory market winter, except for AI servers and automotive electronics, while generative AI applications like ChatGPT drove interest in high-speed memory technologies like DDR5 DRAM and HBM (High Bandwidth Memory), especially in data centers. (Yole)

Retail revenues for US consumer technology will grow 2.8% in 2024 to $512 billion, up $14 billion from 2023. (Consumer Technology Association)

The defense electronics market is projected to reach $213 billion by 2028, up from $167 billion in 2023, a CAGR of 5.1%. (Markets and Markets)