Flex, IC Substrates Demand Give Cheer to Japan PCB Market

TOKYO – Printed circuit board production in Japan in February fell 9.3% from a year ago, falling to 757,000 sq. m. It was the 25th straight month of decline.

Sales fell 11.4% to 44.3 billion yen ($286 million), down the 16th month in a row. The year-over-year drop has reached double digits in 12 straight months.

The data include production of rigid and multilayer boards, flexible circuits and IC substrates, and are tabulated by the Japan Electronics Packaging Circuits Association (JPCA).

Rigid PCB production fell 13.9% from a year ago to 594,000 sq. m., the 24th consecutive month of decline, and revenue dropped 3.9% to 28.6 billion yen ($182.6 million), down for the 18th straight month.

Flex circuit production, a bright spot, rose 9.1% to 118,000 sq. m., reversing nine months of declines. Sales were up for the second straight month, rising 8.8% to 2.62 billion yen ($16.7 million).

IC substrate fabrication jumped 23% to 45,000 sq. m., the fifth consecutive rise. Sales were down for the 11th straight month, dropping 26.6% to 13.1 billion yen ($83.6 million).

Through February, PCB production in Japan was down 13% to 1.4 million sq. m., and sales were off 15.4%, at 83.7 billion yen ($534.4 million).

Rigid board production was down 17%, offset in part by a 4.2% increase in flexible demand and an 18% jump in IC substrates.

Hot Takes

PCB and MCM design software sales rose to $410.8 million in the fourth quarter, a 21% year-over-year increase. The four-quarter moving average, which compares the most recent four quarters to the prior four, rose 18.9%. (ESD Alliance)

Revenues among the top 50 EMS companies declined 5.7% year-over-year in 2023, primarily due to drops at Foxconn and Pegatron. (MMI)

Taiwan’s PCB industry should see revenues grow 6.3% this year, driven by robust demand for advanced PCBs used in AI applications and electric vehicles. (Taiwan Printed Circuit Association)

India’s electronics manufacturing industry is projected to grow 41% annually until fiscal 2026, reaching Rs 5,980 billion ($71.7 billion). (Equiris Securities)

Global smartphone shipments increased 7.8% year-over-year to 289.4 million units in the first quarter. (IDC)

The worldwide copper foil market is expected to rise to $14.85 billion by 2033 from $7.41 billion in 2023. (Spherical Insights & Consulting)

Worldwide sales of semiconductor manufacturing equipment edged down 1.3% to $106.3 billion in 2023 from a record $107.6 billion in 2022. (SEMI)

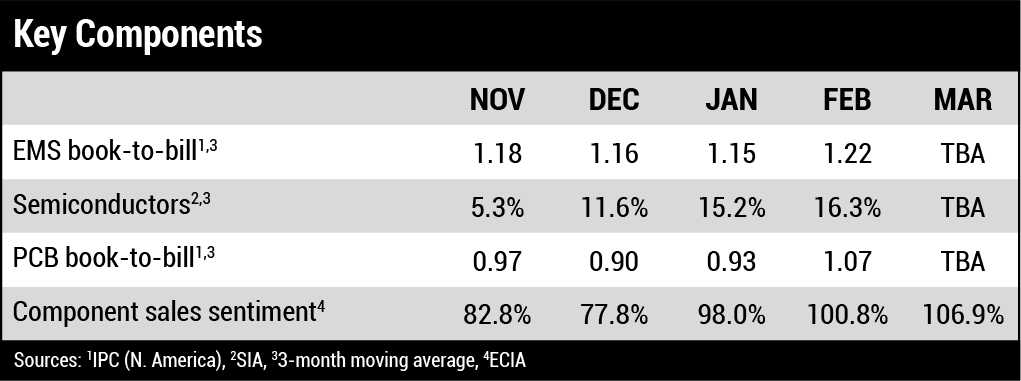

Global semiconductor sales totaled $46.2 billion in February, a year-over-year increase of 16.3%. (Semiconductor Industry Association)

After two years of decline, the worldwide traditional PC market returned to growth during the first quarter with 59.8 million shipments, growing 1.5% year-over-year. (IDC)

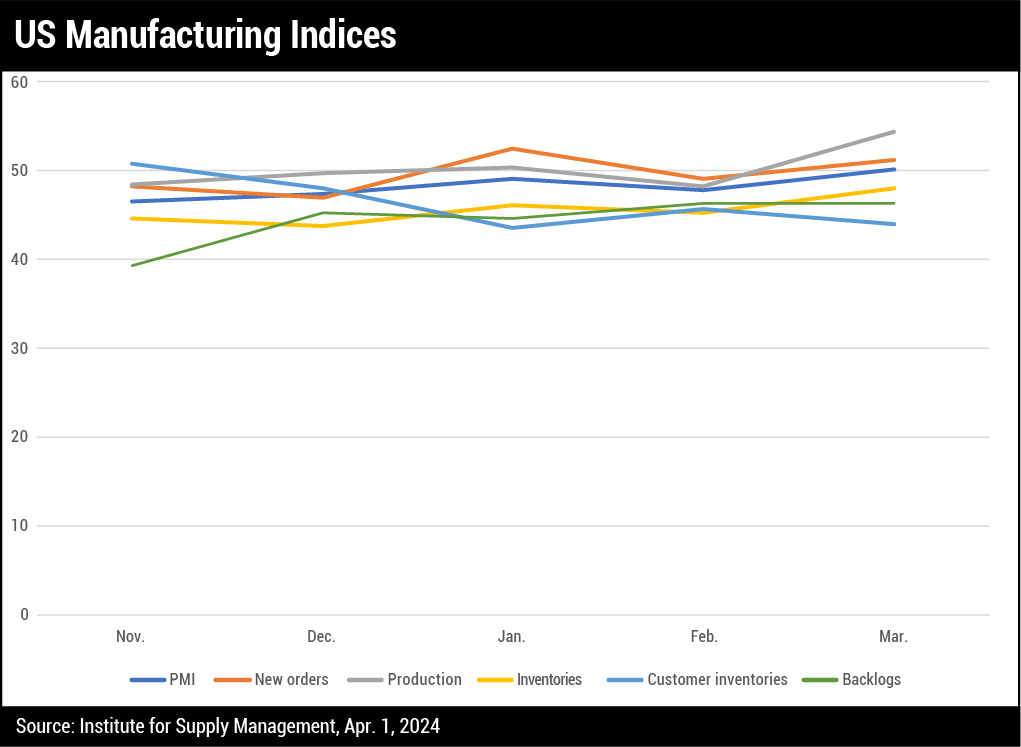

Sentiment among electronics manufacturers remains positive, with demand reaching the highest level in a year. Firms that rely on borrowed capital indicated they are seeing an impact on material costs, inventories and orders as a result of higher interest rates, which then filters down to reduced capex spend and ability to grow and invest in other areas of the business. The new orders index rose to the highest level since July 2022. (IPC)

Global 300mm fab equipment spending for front-end facilities is forecast to reach a record $137 billion in 2027 after topping $100 billion for the first time by 2025. (SEMI)

Production of electronic components, mainly semiconductors and displays, jumped 11.1% annually last quarter, thanks to strong demand for chips used in AI and HPC devices. Production of computers and optical components increased 17.7% from a year ago, bolstered by higher demand for AI and cloud-based data centers. (Taiwan Ministry of Economic Affairs)

US companies borrowed 7% less to finance equipment investments in March compared to a year ago. (Equipment Leasing and Finance Association)

Hiring in India’s electronics industry increased 154% year-over-year in March, with telecom topping the hiring demand. (Quess)

The AR microdisplay market will grow at a faster pace than VR over the next five years, with AR seen as the ultimate consumer market and VR serving as a pathway for credibility and app development. (Yole)

Vietnam’s electronics exports in the first quarter rose 35.7% to $16.33 billion. (Vietnam Customs Department)