Summer Doldrums Hit Japan’s PCB Market

TOKYO – Japan’s printed circuit board recovery remained mixed in August, as rigid board sales fell nearly 10% year-over-year on a nearly 13% drop in production output.

The data are compiled by the Japan Electronics Packaging and Circuits Association (JPCA) based on reporting from scores of domestic manufacturers.

Flex boards were nearly flat, growing 0.7% from a year ago in sales, while output was down about 7%. IC substrate sales were the outlier, rising 11% for the period despite a production drop of about 2%.

For the year, flex circuits sales are up 6.5% on a 1.3% rise in output. Rigid board sales are down 5.4% on a 13% drop in output, and IC substrates are down 11% in revenues despite a 10% increase in output.

Hot Takes

Fourth-quarter memory prices will see a significant slowdown in growth, with conventional DRAM expected to increase 0-5%. (TrendForce)

Global smartphone shipments increased 4% year-over-year to 316.1 million units in the third quarter. (IDC)

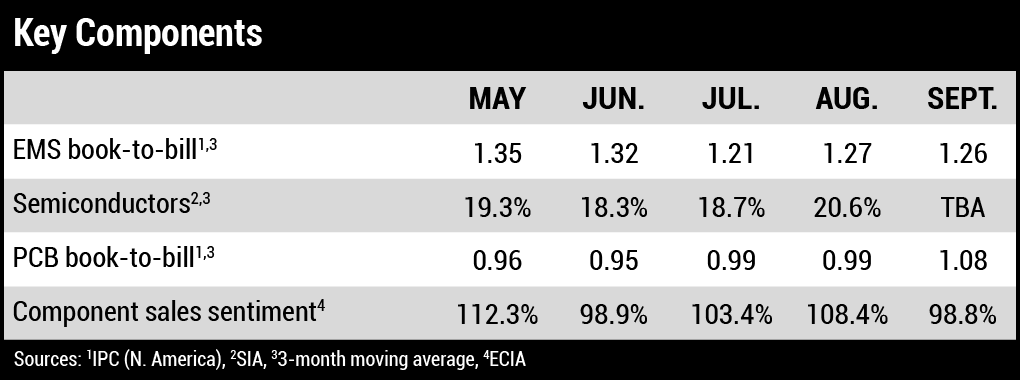

North American EMS shipments in September were up 10.3% year-over-year and 2% sequentially. Bookings rose 19.6% from a year ago but fell 10.8% from the previous month. (IPC)

September North American PCB shipments plunged 24.1% year-over-year and 23.8% sequentially. Bookings slipped 4.4% from a year ago and 2.8% from the previous month. (IPC)

Global semiconductor sales hit $53.1 billion in August, the highest-ever total for the month and a year-over-year increase of 20.6%. (SIA)

Electronics industry sentiment declined significantly in September due to rising cost concerns and weakening demand. (IPC)

Singapore’s electronics production slowed in September, growing 1.9% year-over-year compared with 50% in August, on slower demand for infocom and consumer electronics. (Singapore Economic Development Board)

The Philippines expects a 5% growth in electronics exports next year amid inventory correction and the expected entry of new investments. (SEIPI)

Mexico’s Chihuahua state aims to develop supply chains related to chips and circuit boards to improve its competitiveness.

India is expected to limit imports of laptops, tablets and personal computers after January, a move to push companies such as Apple to increase domestic manufacturing. (Reuters)

Taiwanese AI server supply-chain firms are preparing for an anticipated surge in demand from major cloud service providers. (Quanta)

NAND contract prices will drop 10%+ in the fourth quarter and NAND wafer contract prices will slip 10-15%. (TrendForce)

Taiwan’s passive components supply chain is anticipating a favorable market outlook for 2025, a result of the demand generated by AI device applications, according to industry sources. (DigiTimes)

Global TV shipments in September increased 15% compared with the same period last year, marking the eighth month of 2024 that shipments have achieved year-on-year growth. (Luotu Technology)